Advertisement|Remove ads.

Centene Reports Unexpected Q2 Loss: But Retail Expects Stock To Close Higher

Health insurer Centene Corporation (CNC) announced its second-quarter earnings on Friday, which fell below Wall Street estimates.

Shares of the company traded as low as 9% in the pre-market session but reversed losses and traded over 4% higher at the time of writing.

CEO Sarah M. London acknowledged being “disappointed” by the company’s second-quarter results.

“...we have a clear understanding of the trends that have impacted our performance, and are working with urgency and focus to restore our earnings trajectory," she said. “Despite the shifting landscape, we believe that the staying power of Medicaid, Medicare, and the Individual Marketplace is as strong as it has ever been.”

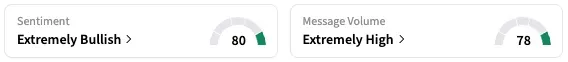

On Stocktwits, retail sentiment around Centene jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from high to extremely high levels.

For the second quarter, Centene reported total revenue of $48.74 billion, above an analyst estimate of $44.20 billion, according to data from Fiscal AI. Premium and service revenues increased 8% to $42.5 billion in the quarter from $36.0 billion in the comparable period of 2024.

Adjusted and diluted loss per share came in at $0.16, below an estimated earnings of $0.23 per share.

Centene’s medical cost ratio, meanwhile, came in at 93%, up from 87.6% in the corresponding period of 2024. Medical cost ratio refers to the percentage of premiums used to pay for medical claims.

The company said that the increase was primarily driven by a reduction in the company's net 2025 Marketplace risk adjustment revenue transfer estimate, increased Marketplace medical costs, and higher medical costs in Medicaid, driven primarily by behavioral health, home health and high-cost drugs, among others.

A Stocktwits user turned cautious and highlighted they are selling their holdings of the stock.

Another, however, expressed optimism that the stock would close higher at the end of the day.

Centene withdrew its 2025 earnings guidance earlier this month due to an expected decline in revenue under plans associated with the Affordable Care Act, also known as Obamacare.

CNC stock is down 56% this year and by about 60% over the past 12 hours.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)