Advertisement|Remove ads.

Gilead Gets Analyst Thumbs Up On Market Potential Of HIV-Prevention Injection, But Retail’s Not Ready To Cheer Yet

Needham on Friday upgraded Gilead Sciences, Inc. (GILD) to ‘Buy’ from ‘Hold’ as it is confident that the company’s HIV prevention injection Lenacapavir could be a multi-billion dollar contributor to sales growth over the next few years.

The firm has a $133 price target on the stock, representing an upside of about 17.5% to the stock’s closing price on Thursday.

The firm conducted a survey, which indicated that physicians expect a 49% increase in the current HIV prevention market by 2030, with Lenacapavir capturing a 38% market share, the analyst told investors in a research note.

Needham believes this is not captured in consensus estimates and that Lenacapavir, branded as Yeztugo in the U.S., is a key driver for Gilead shares.

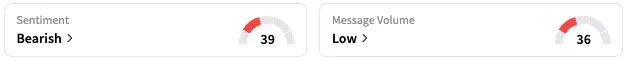

On Stocktwits, retail sentiment around Gilead trended in the ‘bearish’ territory, coupled with ‘low’ message volume. The stock is up about 0.5% in Friday’s pre-market session.

Separately, Gilead announced on Friday that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) adopted a positive opinion for the approval of the drug. The recommendation now has to be formally approved by the European Commission (EC).

The final EC decision is expected later this year, and, if approved, Lenacapavir will be marketed in the European Union (EU) under the trade name Yeytuo.

Lenacapavir will also be granted one additional year of market exclusivity in the EU if approved.

The U.S. Food and Drug Administration approved Lenacapavir in June. It is a twice-yearly, long-acting injectable for use as pre-exposure prophylaxis (PrEP) by HIV-negative individuals to significantly reduce the risk of contracting HIV.

Pre-exposure prophylaxis (PrEP) is the use of antiviral drugs to prevent HIV infection in individuals who do not have HIV but are at risk of contracting it.

GILD stock is up by 23% this year and by about 48% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)