Advertisement|Remove ads.

CenterPoint Energy’s Stock Dips As Mixed Q4 Earnings Overshadow $500M Grid Investment: Retail Sentiment Sours

CenterPoint Energy Inc. (CNP) shares fell more than 1% on Thursday after the utility reported mixed Q4 earnings, weighing on retail sentiment, even as it raised its 10-year capital spending plan by $500 million.

The Houston-based electric and gas utility posted earnings of $0.40 per share, which is in line with analyst estimates.

Revenue rose to $2.55 billion, surpassing the consensus forecast of $2.45 billion.

CenterPoint’s $500 million increase to its 10-year capital expenditure plan brings its total planned spending through 2030 to $47.5 billion.

The additional investment aims to strengthen grid resilience in the Houston region as the company prepares for a surge in electricity demand from new data centers and other industrial expansions.

CenterPoint expects power demand in its Houston Electric service territory to grow nearly 50% by 2031.

“Like our peers, we have experienced an unprecedented level of interest in connecting to our grid...we have received approximately 40 gigawatts in load interconnection requests," CFO Christopher Foster said during the company’s earnings call.

CEO Jason Wells noted that while Texas transmission upgrades are a significant focus, they are not the company’s only capital investment drivers.

“We haven’t set a date, but we're committed to providing an update to the market this year,” he said, adding that the company’s broader capital spending initiatives are expected to drive long-term growth.

CenterPoint reaffirmed its 2025 earnings guidance range of $1.74 to $1.76 per share, reflecting an 8% increase from 2024 at the midpoint.

The company also reiterated its target of mid- to high single-digit annual EPS growth of 6% to 8% through 2030.

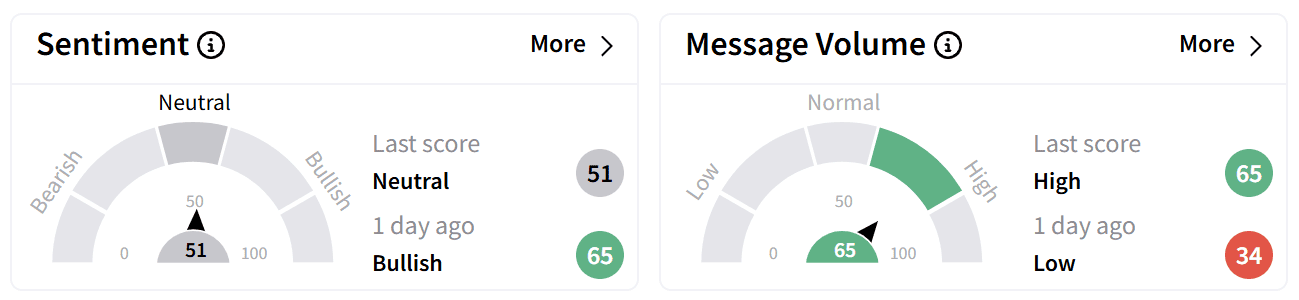

On Stocktwits, retail sentiment shifted to ‘neutral (51/100) from ‘bullish’ a day ago, as chatter increased to ‘high’ levels.

CenterPoint shares have climbed 20% over the past year and are up 4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: EPAM Systems Stock Plunges After Weak Guidance Overshadows Earnings Beat, Denting Retail Optimism

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)