Advertisement|Remove ads.

Charles River Labs Stock Soars On Strategic Review Plan With Elliott: Retail Investors Optimistic

Shares of Charles River Laboratories gained on Wednesday after the company disclosed plans for a strategic review aimed at improving long-term shareholder value.

The review will be conducted in partnership with Elliott Investment Management L.P., the company’s largest shareholder, following the signing of a Cooperation Agreement.

Charles River Laboratories shares rose by 18.68% to close at $136.97 on Wednesday.

Under the terms, Elliott has agreed to standard standstill, voting, and confidentiality provisions.

The announcement was accompanied by news that four new independent directors — Steven Barg, Abe Ceesay, Mark Enyedy, and Paul Graves — will join Charles River’s board after the 2025 Annual Meeting of Shareholders on May 20.

The reshuffle also includes the departure of four existing board members, who will not seek re-election.

Charles River's board will now consist of eleven directors, nine of whom will be independent.

The company said that the new directors, with their "seasoned industry expertise," would help optimize operational performance, drive efficiencies, and enhance shareholder value.

The newly formed Strategic Planning and Capital Allocation Committee will oversee the strategic review, which aims to evaluate various alternatives to boost the company’s long-term prospects.

The review comes amid a challenging operating environment for Charles River, which faces pressures such as biotech funding softness and government budget cuts.

The company has also been dealing with significant changes in the regulatory landscape, including recent shifts in animal-based testing guidelines.

For the first-quarter (Q1), Charles River reported revenue of $984.2 million, a 2.7% decrease from the previous year, driven by declines across all three of its business segments.

The company's net income was $25.5 million, or $0.50 per share, down from $67.3 million, or $1.30 per share, in Q1 2024.

On a non-GAAP basis, the company reported diluted earnings per share of $2.34, reflecting a 3.1% increase from the previous year.

The stock's rise also comes as analysts raised their outlook on the company.

Evercore ISI upgraded Charles River to Outperform from In Line and raised its price target to $170 from $135, citing a rebound in bookings and the company’s strong position in preclinical development, according to Koyfin.

The firm also pointed to Charles River's market position and its ongoing efforts to pivot toward non-animal-based testing methods.

"We are encouraged by the reacceleration of bookings, the first quarter-over-quarter increase since 2022, and the company's overall strategy," an Evercore ISI analyst said.

Similarly, CFRA raised its price target on Charles River to $152 from $107, following a Q1 earnings beat and stronger-than-expected bookings, Koyfin data said.

CFRA analysts highlighted the resilience of Charles River’s Discovery and Safety Assessment (DSA) segment and expressed optimism about the company's future prospects with Elliott’s involvement.

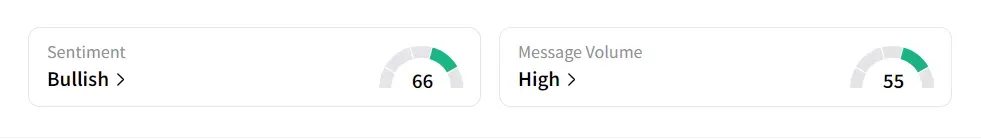

On Stocktwits, Sentiment was ‘bullish’ amid ‘high’ message volume.

Shares of Charles River have fallen 25% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)