Advertisement|Remove ads.

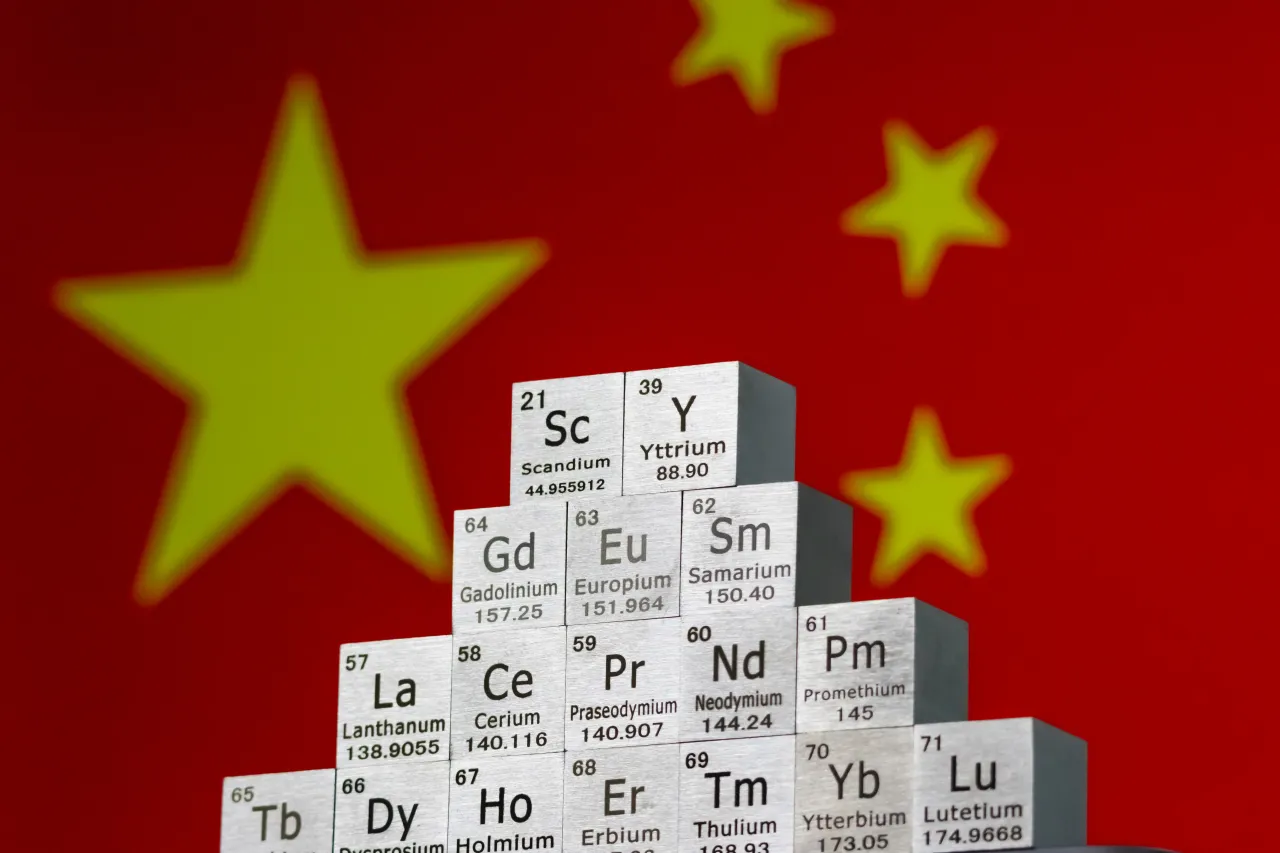

China Reportedly Planning To Keep Rare Earths Out Of The Reach Of U.S. Military — What Could It Mean For MP, TMC, TMQ Stocks?

- The VEU mechanism that Xi Jinping’s government is considering is reportedly modeled on existing U.S. laws and procedures, as is much of Beijing’s export-control architecture.

- China dominates over 90% of refined rare earth, which are used in a wide range of applications, ranging from semiconductors to missile defense systems.

- Late last month, the U.S. and China reached an agreement to ease rare-earth exports for at least a year.

China is reportedly designing a system for rare earth exports that will exclude companies with ties to the U.S. military while fast-tracking export approvals for other firms.

According to a Wall Street Journal report, citing people familiar with the plan, Beijing intends to deploy the “validated end-user” system, or VEU, which would enable China to follow through on a pledge to U.S. President Donald Trump to facilitate the export of rare earth materials while ensuring that they don’t end up with U.S. military suppliers, a core concern for China.

The report added that if the system were strictly implemented, it could make it more difficult for automotive and aerospace companies with both civilian and defense clients to import certain Chinese materials. The report further highlighted that Beijing’s plan could still change, and its licensing system wouldn’t be certain until it is implemented.

Taking A Page Out Of The U.S. Playbook

The VEU mechanism that Xi Jinping’s government is considering is reportedly modeled on existing U.S. laws and procedures, as is much of Beijing’s export-control architecture. Under the U.S. version of the VEU system, which took effect in 2007, some Chinese companies can purchase sensitive goods under a general authorization rather than obtaining individual licenses for each transaction.

The U.S. rule facilitates the import of controlled goods, such as chemicals or chip-making equipment, by requiring participating companies to approve U.S. government inspections of their facilities. The report stated that it isn’t clear how long VEU protections would last.

What It Would Mean For U.S. Miners?

China dominates over 90% of refined rare earth, which are used in a wide range of applications, ranging from semiconductors to missile defense systems. Late last month, the U.S. and China reached an agreement to ease rare-earth exports for at least a year.

The White House has stepped up its efforts over the past months to increase domestic production of critical minerals. The U.S. has taken stakes in companies such as Lithium Americas, MP Materials, Critical Metals, and Trilogy Metals. The White House has also stated that it is in talks with many other companies over potential stakes. China’s reluctance to ship to defense firms could potentially ensure that the Trump administration continues its efforts to secure the domestic supply.

What Are Stocktwits Users Thinking?

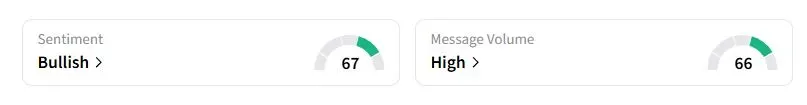

Retail sentiment on Stocktwits about MP Materials, the top U.S. rare-earth producer, was in the ‘bullish’ territory.

MP Materials stock has more than quadrupled this year. Critical Metals stock and USA Rare Earth stock have gained nearly 53% and 25%, respectively.

Also See: Why Is Gevo Stock Rising Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)