Advertisement|Remove ads.

Trump Targets Countries Trading With Iran, Slaps 25% Tariff

- While the president did not provide any further details, he added that “This Order is final and conclusive.”

- Trump’s tariff announcement comes amid widespread protests in the country that have reportedly killed hundreds of protesters.

- The new tariff against Iran’s trading partners comes ahead of the Supreme Court ruling on the legality of Trump’s global tariffs, with the next hearing scheduled for Wednesday.

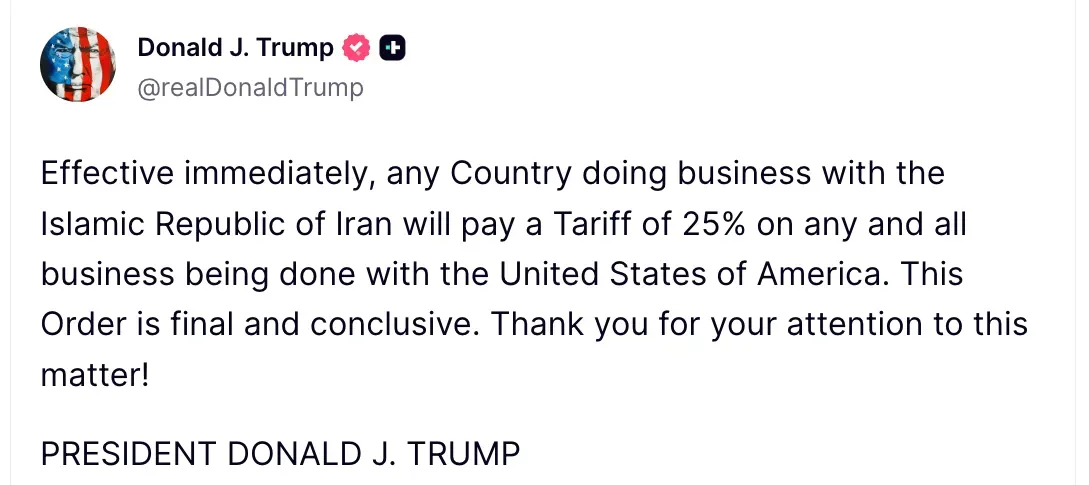

President Donald Trump announced on Monday in a social media post that he is imposing a 25% tariff on all countries doing business with Iran.

“Effective immediately, any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America,” Trump said in a post on Truth Social.

While the president did not provide any further details, he added that “This Order is final and conclusive.”

Iran Protests

Trump’s tariff announcement comes amid widespread protests in the country that have reportedly killed hundreds of protesters. Beginning December 2025, protests in Iran erupted over soaring inflation and have now evolved to a call against the country’s clerical rule of Iran's Supreme Leader, Ayatollah Ali Khamenei.

According to a report from Axios, Trump was considering a strike on Iran, although a final decision had not been made. The president was also exploring Iranian proposals for negotiations, according to a White House official with knowledge on the matter, as per Axios.

Earlier in the week, Trump posted on Truth Social in support of the protestors, saying, “Iran is looking at FREEDOM, perhaps like never before. The USA stands ready to help!”

Trump’s announcement of new tariffs against Iran’s business partners also comes ahead of the Supreme Court ruling on the legality of Trump’s global tariffs, with the next hearing scheduled for Wednesday.

Economic Implications

Another tariff is likely to disrupt global markets and have implications on trade relationships for countries with the U.S. Iran’s trading partners include large economies like India, Turkey, and China.

At present, India is looking at 50% tariffs on its exports to America, largely due to its Russian crude oil imports. While both countries have been negotiating for months, a deal has not yet been finalized. China, which is the largest importer of Iranian crude oil, could face a disruption of the trade deal reached late last year.

Meanwhile, U.S. equities were largely unchanged in Monday’s after-hours trading after ending the day in green. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was largely unchanged after closing 0.16% higher at the end of the day. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The Invesco QQQ Trust ETF (QQQ) was also unchanged after ending the day 0.08% higher, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.09% in after-market hours after closing 0.18% higher.

The iShares 7-10 Year Treasury Bond ETF (IEF) was also unchanged after having closed down by 0.12%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)