Advertisement|Remove ads.

Chipotle Stock Slumps On Forecast Cut, Q2 Sales Miss: Retail Smells Buying Opportunity

Chipotle Mexican Grill (CMG) delivered a disappointing quarterly report on Wednesday, pushing its stock lower. Still, retail sentiment on Stocktwits turned sharply bullish, with many investors betting on a rebound.

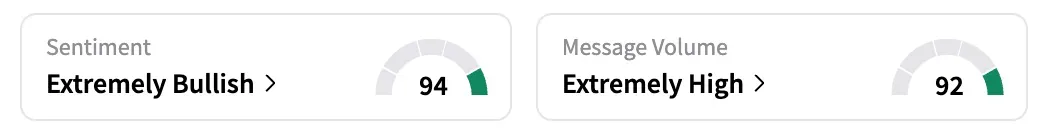

Sentiment turned higher in the 'extremely bullish' territory (94/100), even as shares dropped nearly 10% in post-market trading. CMG was among the top three trending tickers on Stocktwits at the time of writing.

User comments were mixed: some raised concerns over softening demand and declining foot traffic, while others expressed optimism about a rebound, citing the stock's recent dip and encouraging analyst commentary.

"$CMG right in the value zone for bulls to buy this beast," a user said.

CMG stock has followed a pattern of sharp peaks and troughs over the past 12 months, and it is currently down about 10% from its most recent high on July 1.

The Mexican food chain reported second-quarter revenue on Wednesday that missed analysts' expectations and lowered its annual sales growth target.

Consumers are dining out less amid high inflation and economic uncertainty, putting pressure on the restaurant industry, which is also grappling with rising costs driven by U.S. tariffs.

Chipotle now expects annual comparable restaurant sales to be approximately flat year-over-year, down from its prior target of low single-digit growth.

Revenue rose to $3.06 billion for the quarter ended June, up from $2.97 billion in the year-ago quarter, but missed analysts' $3.11 billion estimate from FaceSet. However, comparable store sales fell 4%, steeper than a 2.9% decline forecast by LSEG/Reuters.

Adjusted earnings dropped by $0.01 to $0.33 per share, in line with estimates.

Chipotle’s management noted that the dip in demand is primarily among lower-income consumers. In response, the company is intensifying its marketing initiatives and refining its rewards program to help mitigate the slowdown.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)