Advertisement|Remove ads.

ChargePoint, EVgo Post Bigger Losses Than Feared — But Retail Traders Stay Plugged In Amid Trump Policy Shifts

Shares of ChargePoint Holdings, Inc. and EVgo, Inc. were in focus Tuesday after both EV-charging firms reported bigger quarterly losses than Wall Street expected.

Despite the weak results, retail traders showed resilience, betting on the sector’s long-term growth prospects amid shifting political policies.

After the closing bell on Tuesday, ChargePoint reported a fourth-quarter (Q4) loss of $0.14 per share, slightly worse than the expected $0.13 loss.

Revenue came in at $101.9 million, narrowly beating the consensus of $101.1 million.

CFO Mansi Khetani highlighted a sharp improvement in cash usage, noting that cash used for operating activities dropped to $3 million in Q4 from $31 million in Q3, thanks to higher margins, lower expenses, and better inventory management.

For the first quarter of 2025, ChargePoint expects revenue between $95 million and $105 million, compared to Wall Street’s estimate of $102.1 million.

The company reaffirmed its goal of achieving positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in a quarter of fiscal 2026.

Stocktwits chatter was largely optimistic late Tuesday, with one trader suggesting ChargePoint might announce another contract from General Motors soon.

ChargePoint and GM previously partnered to deploy 500 ultra-fast charging ports under the GM Energy brand.

Another user speculated that Tesla’s recent setbacks in charging infrastructure could work in ChargePoint’s favor.

Meanwhile, EVgo posted a Q4 loss of $0.11 per share before the market opened, wider than the expected $0.09 loss.

Revenue fell short at $67.5 million, compared to analyst expectations of $69.09 million.

However, charging network revenue surged 73% year-over-year to a record $46.5 million, marking its ninth consecutive quarter of double-digit growth.

EVgo ended the quarter with 4,080 charging stalls in operation and reaffirmed its commitment to scaling.

CEO Badar Khan said EVgo has secured financing to more than triple its installed base within five years and reiterated the company’s goal of reaching adjusted EBITDA breakeven in 2025.

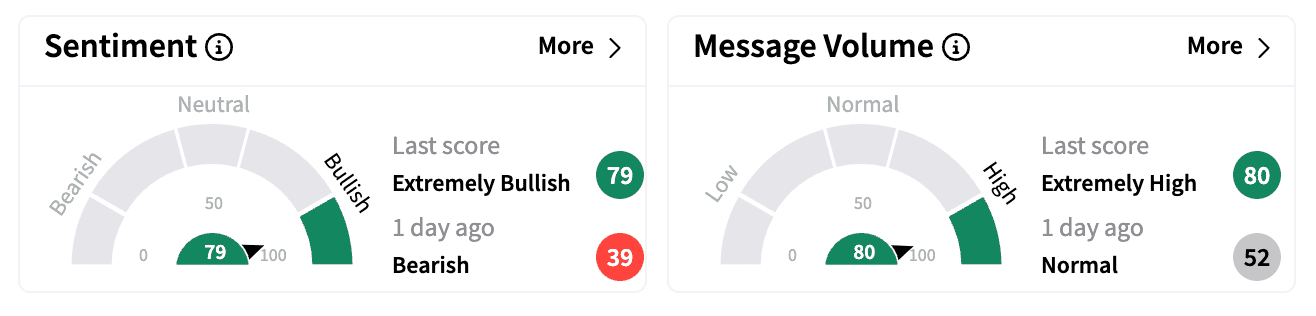

Despite the earnings miss, retail sentiment on Stocktwits turned ‘extremely bullish,’ with message volume up 176% in the past 24 hours.

One trader called EVgo’s growth “overlooked” and said they were adding to their position.

Another user speculated that tariffs under a Trump administration could drive EVgo demand, as struggling malls and supermarkets might seek new revenue streams by funding EV charger installations independently.

Following the results, TD Cowen cut its price target on EVgo from $7 to $5 but maintained a ‘Buy’ rating.

Short interest remains high for both stocks, with ChargePoint’s at 27.4% and EVgo’s at 32.2%, per Koyfin data.

Both companies remain under pressure as former President Donald Trump has vowed to roll back EV-related spending and incentives initiated under President Joe Biden.

ChargePoint stock has lost about 38% this year, while EVgo has shed 40%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)