Advertisement|Remove ads.

Ciena Stock Edges Lower Ahead Of Q1 Results: Wall Street Expects Earnings Decline, Retail Turns Bearish

Shares of Ciena Corp. (CIEN) edged lower by 0.8% in after-market trading on Monday ahead of the company’s first-quarter results before the open on Tuesday.

The networking systems and software provider is expected to post earnings per share (EPS) of $0.41 during the quarter, falling from $0.66 that it reported in the year-ago period.

As for the topline, Ciena is expected to report revenue of $1.05 billion in Q1, marginally higher than the $1.04 billion it posted during the same period a year earlier.

Past data shows Ciena has beaten earnings expectations in three of the past four quarters, but it surpassed revenue estimates in all of them.

Ahead of Ciena’s Q1 results, analysts at Rosenblatt trimmed the price target to $79 from $94, citing a contraction in artificial intelligence (AI) multiples. The brokerage has a ‘Neutral’ rating for Ciena, according to The Fly.

Last month, Lumen Technologies selected Ciena to integrate the Maryland-headquartered company’s high-bandwidth transceiver with its products. Ciena’s solutions will reduce the space and power required per bit by 50%, Lumen said.

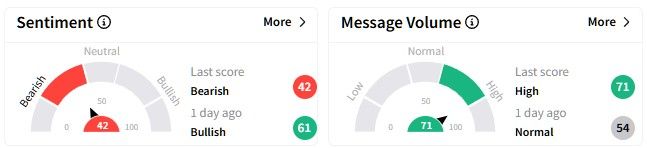

Retail sentiment on Stocktwits declined, though, entering ‘bearish’ (42/100) territory from ‘bullish’ a day ago. Message volume surged to ‘high’ levels, showing an increase in retail interest as the earnings announcement drew close.

One user posted a bearish outlook for Ciena, with a price target of $51.

Ciena’s stock has declined nearly 23% year-to-date, but its one-year performance is relatively better, with gains of over 27%.

FinChat data shows of 15 brokerage recommendations, there are five ‘Buy', four ‘Outperform,’ and six ‘Hold’ ratings. The average price target is $89, implying a 37% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)