Advertisement|Remove ads.

Cigna Reports Upbeat Q1 Earnings, Raises Full-Year Outlook: Retail’s Elated

Shares of The Cigna Group (CI) traded 1% higher in Friday’s pre-market after the company’s first-quarter earnings topped Wall Street estimates and full-year earnings guidance saw an upward revision.

The company reported total revenue of $65.50 billion, marking a 14% growth compared to the corresponding period of 2024 and above an analyst estimate of $60.38 billion, as per Finchat data.

Adjusted earnings per share (EPS) came in at $6.74, up from $6.47 in the first quarter of 2024, and above an analyst estimate of $6.35.

The Cigna Group includes products and services marketed under Evernorth Health Services and Cigna Healthcare.

While Evernorth Health Services unit’s adjusted revenue jumped 16% to $53.68 billion in the quarter, pre-tax adjusted income from operations rose 5% to $1.43 billion.

Cigna Healthcare recorded adjusted revenues of $14.48 billion in the quarter, marking a growth of 9%. However, pre-tax adjusted income from operations fell to $1.29 billion from $1.34 billion in the corresponding quarter of 2024, owing to a higher medical cost ratio (MCR).

The company’s medical cost ratio, which represents medical costs as a percentage of premiums, stood at 82.2% for the first quarter (Q1) of 2025 compared to 79.9% for Q1 2024. The company said the increase was primarily driven by expected higher stop loss medical costs.

The company raised its full-year adjusted EPS guidance to at least $29.60, marking an increase of $0.10 from its prior guidance. The new guidance includes expected future share repurchases and anticipated 2025 dividends.

The company now expects adjusted income from operations of at least $7.20 billion from Evernorth and $4.13 billion from Cigna Healthcare.

The company's MCR is expected to be between 83.2% and 84.2% for the full year, as provided in its prior guidance.

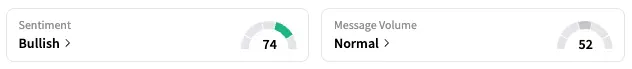

On Stocktwits, retail sentiment around CI stock rose from ‘neutral’ to ‘bullish’ territory over the last 24 hours while message volume rose from ‘extremely low’ to ‘low’ levels.

CI stock has gained by 22% this year but has declined by 3% over the past 12 months.

Also See: Shell Gains After Q1 Profit Beat, $3.5B Stock Buyback Pledge: Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)