Advertisement|Remove ads.

Shell Gains After Q1 Profit Beat, $3.5B Stock Buyback Pledge: Retail’s Bullish

Shell’s (SHEL) U.S.-listed shares gained 3.9% in premarket trading on Friday after the company topped analysts’ expectations for quarterly earnings.

The London-listed oil major reported adjusted net income of $5.58 billion for the first quarter, down from $7.73 billion a year earlier but higher than analysts’ expectations of $5.07 billion, according to a Bloomberg report.

The company’s indicative refining margin fell to $6.20 per barrel from $12 per barrel a year earlier. But it rose sequentially from $5.50 per barrel in the previous quarter.

“Our strong performance and resilient balance sheet give us the confidence to commence another $3.5 billion of buybacks for the next three months,” CEO Wael Sawan said in a statement.

Sawan’s upbeat commentary comes amid a sharp drop in oil prices due to recession fears and supply hikes by the OPEC+ producer group.

Shell also reaffirmed its annual investment budget of between $20 billion and $22 billion.

Major energy firms are navigating a challenging environment due to a decline in oil prices, as they have to decide whether to boost capital investments in new projects or focus on shareholder returns.

The company forecasts that in the second quarter, production will be between 890,000 and 950,000 barrels of oil equivalent per day.

Its first-quarter production averaged 927,000 boepd.

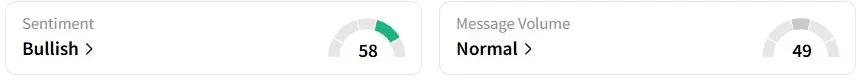

Retail sentiment on Stocktwits was in the ‘bullish’ (57/100) territory, while retail chatter was ‘normal.’

Shell stock has risen 2.9% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)