Advertisement|Remove ads.

Cigna Dips, Humana Rises Amid Revived Merger Discussions: Retail Sentiment Divided

Cigna ($CI) shares slid 4%, while Humana ($HUM) gained as much as 5% pre-market on Monday amid reports that the two companies have revived merger discussions.

The health insurance companies, with a combined market value exceeding $125 billion, have recently held informal discussions about a potential merger after talks fell apart late last year, according to Bloomberg.

These early-stage negotiations are occurring against the backdrop of federal pressure to rein in Medicare costs, which have taken a toll on Humana’s financial stability and market position. The company’s stock has fallen 41% this year so far.

Sources told Bloomberg that Cigna is looking to close the sale of its Medicare Advantage business in the coming weeks before committing to any other transactions. Cigna and Humana held talks to merge last year as well, but Cigna walked away after failing to agree on a price.

Mizuho analyst Ann Hynes said that a merger could potentially lead to a Department of Justice (DOJ) lawsuit but it shouldn’t stop the deal from happening. The analyst highlighted that Humana’s buyout by Cigna is likely. “It’s just a matter of timing,” said the research note.

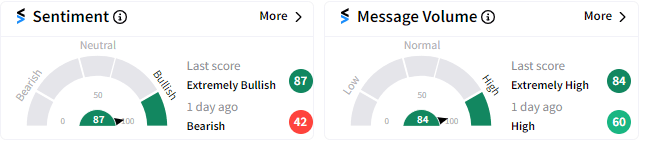

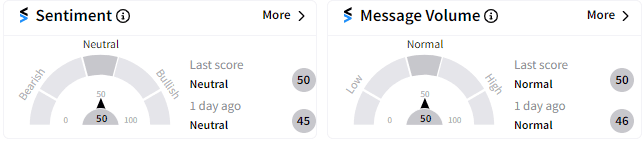

Retail sentiment around Cigna has flipped to ‘extremely bullish’ (87/100) from ‘bearish’ a day ago, while retail sentiment around Humana on Stocktwits continues to be ‘neutral’ (50/100).

Users are divided on whether the deal will come through and whether Cigna returning to the table diminishes its negotiating power.

Cigna’s stock has gained 4% so far in 2024, and 7% over the last 12 months.

For updates and corrections email newsroom@stocktwits.com

Read More: BioNTech Stock Dips On FDA Concerns Over Cancer Drug Trial: Retail Response Mixed

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)