Advertisement|Remove ads.

Citi Initiates Coverage On DLocal With ‘Buy’ Rating: Retail Still Leans Bearish

Citi has initiated coverage on Uruguayan payments firm DLocal with a 'Buy' rating and a $14.60 price target, theFly reported.

The price target was higher than its previous close on Friday.

The brokerage said that global competition remains concentrated in developed markets, making DLocal the "certain choice" for merchant expansion towards emerging markets.

The stock has a consensus price target of $12.39, according to FinChat data.

Earlier this month, brokerage Susquehanna had set a street-high price target of $18 citing improvement across important metrics.

In May, the company topped first-quarter revenue expectations after its total payment volume jumped 53% to a record $8.1 billion.

DLocal said that the rise was driven by sustained expansion in cross-border payment volumes in Chile, Pakistan, Nigeria, Turkey, and Brazil, and robust growth from sectors such as remittances, commerce, financial services, and streaming.

Citi also highlighted the initiation of the company’s annual dividend, which is equal to 30% of its free cash flow.

The first dividend under its policy would be payable in 2026 based on the company’s free cash flow performance.

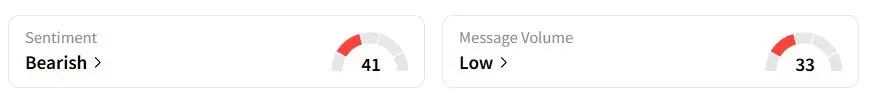

Retail sentiment on Stocktwits was still in the ‘bearish’ (42/100) territory, while retail chatter was ‘low.’

One retail trader suggested that the stock should be trending.

It was down 3.2% in premarket trading amid low volumes.

DLocal had announced in March that Mark Ortiz would step down from his role as CFO due to an unforeseen health issue.

DLocal stock has fallen marginally this year.

Also See: Wildfires Threaten Alberta Oil Operations; Canadian Natural Among Firms At Risk

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)