Advertisement|Remove ads.

Citi Lifts Nvidia Price Target To $220, Predicts Earnings Beat

- The new price target reflects a 17% upside to the stock’s closing price as of Friday.

- Citi anticipates Nvidia will forecast fourth-quarter revenue around $62 billion.

- UBS expects Nvidia to guide a Q4 revenue between $63 billion and $64 billion.

Citi has raised its price target for NVIDIA Corp. (NVDA) to $220 per share from $210, maintaining a ‘Buy’ rating ahead of the chipmaker’s third-quarter earnings announcement on November 19.

The new price target reflects a 17% upside to the stock’s closing price as of Friday.

Stronger Sales And Guidance

The firm also opened an ‘upside 30-day short-term view,’ signaling confidence that Nvidia will outperform expectations in its upcoming results, according to TheFly.

According to a CNBC report, Citi analyst Atif Malik projects Nvidia will post sales of approximately $56.8 billion for Q3, compared with analysts’ consensus of $54.6 billion.

He also anticipates the company will forecast fourth-quarter (Q4) revenue around $62 billion, exceeding Street expectations of roughly $61 billion. Malik cited strong AI infrastructure spending and Nvidia’s milestone of six million Blackwell chips shipped as key drivers of growth.

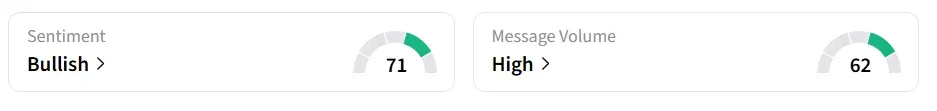

Nvidia’s stock traded over 3% higher on Monday morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Despite Nvidia’s massive rally in recent years, Citi sees the stock’s current valuation as appealing.

What Does UBS Say?

UBS expects Nvidia to guide a Q4 revenue between $63 billion and $64 billion when it reports results. The firm believes the chipmaker could issue even stronger guidance.

UBS maintained its ‘Buy’ rating on Nvidia shares and reiterated its $235 price target, reflecting confidence in the company’s continued leadership in AI-driven computing.

Over the last week, tech stocks in general fell, weighed down by concerns about the potential bursting of the AI bubble. However, market research firm Fundstrat stated that the broader sector remained intact and is positioned for a rebound.

NVDA stock has gained over 46% in 2025 and over 35% in the last 12 months.

Also See: Movano Stock Surges 178% After Announcing Merger With AI Cloud Firm Corvex

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)