Advertisement|Remove ads.

Citi Pulls Out Of UnionPay As Retail Exit From China Nears Completion

Citigroup (C) has left the UnionPay network in China after shutting its retail banking business in the nation. According to a Bloomberg News report, China UnionPay has approved the exit.

“Our domestic and overseas payment and collection for corporate and institutions are not affected in any way,” the bank reportedly said. “Citi continues to serve corporate and institutional clients in China, meeting their cross-border banking needs.”

Citi decided to exit from China in 2021 among a string of strategic retreats from Asia and Europe. The bank sold its retail wealth management portfolio to HSBC in 2023.

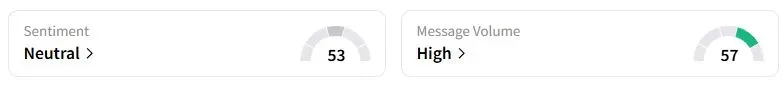

Retail sentiment on Stocktwits about Citi was in the ‘neutral’ territory at the time of writing.

In June, the U.S. bank announced that it would lay off 3,500 technology workers at its China Citi Solution Centers in Shanghai and Dalian by the end of the fourth quarter and shift some roles elsewhere amid the bank’s efforts to rein in costs. Citi CEO Jane Fraser is focused on closing the valuation gap between the bank and its U.S. peers.

Fraser’s efforts have begun to bear fruit gradually. Citi stock has surged nearly 37%, outperforming all major U.S. banks, including JPMorgan & Chase and Wells Fargo.

Wall Street analysts have become increasingly optimistic about the company’s prospects. According to Koyfin data, the stock has an average price target of $101.55, about 25% higher than at the beginning of the year.

According to TheFly, Truist analysts wrote on Wednesday that Citi has a credible path to improve profitability and progress in its journey toward simplification and regulatory compliance.

One Stocktwits user wrote that the stock will not pull back till it reaches the $100 mark.

Also See: Alaska Air To Convert Parts Of Its Boeing 787 Order To The Largest Variant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_rig_bfbf070c8b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1473343393_1_jpg_536dff4c41.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)