Advertisement|Remove ads.

Why Did TWG Stock Nearly Double In Premarket Trading Today?

- Top Wealth Group expects at least $4 million in net profit for FY2025, a sharp rebound from last year’s $2 million loss.

- The upbeat outlook marks a sharp reversal from last year’s steep losses.

- Top Wealth executed a 1-for-90 reverse stock split in July.

Shares of Top Wealth Group Holding Ltd. (TWG) surged 98% in premarket trading on Monday on the back of a bullish FY2025 profit outlook.

TWG was among the top 3 trending tickers on Stocktwits at the time of writing.

Profit Outlook

Top Wealth Group expects total net profits of not less than $4 million for the financial year ending Dec. 31, 2025, marking a significant rebound from a $2 million loss during the same period last year. The turnaround is driven by ongoing improvements across the company’s business operations throughout the current financial year, it said.

“We have worked diligently to enhance our business performance this year, and we are pleased to see these efforts yielding positive results,” said Kim Kwan Kings, Wong, chief executive officer of Top Wealth.

Earlier this year, the company delivered a clear turnaround in its first-half 2025 bottom line. Net profit climbed to $2.4 million in the first half, compared with a net loss of $0.5 million a year earlier. The recovery was driven by stronger cost discipline and progress in rebuilding its wine distribution business.

Cost of sales dropped to $0.8 million in the first half of 2025, a 61.5% decline from $2.1 million in the same period of 2024.

How Did Stocktwits Users React?

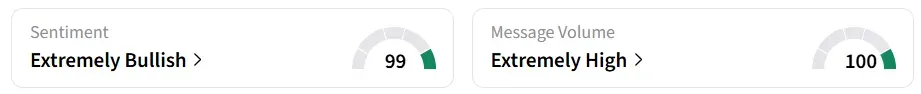

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory over the past 24 hours, accompanied by ‘extremely high’ message volumes.

One user sees TWG’s potential run matching that of SMX’s.

For context, SMX closed at $5.91 on Nov. 25. It was $331.98 at its last close.

Another user sees the stock price potentially rise to $20.

Recent Reverse Split

Top Wealth Group recently executed a 1-for-90 reverse stock split, with post-split trading beginning on July 21. Such moves are common among companies seeking to keep their shares above the $1 minimum required by major exchanges.

By shrinking the share count, a reverse split lifts the stock price, helping the company regain compliance and avoid potential delisting.

Read Also: SELLAS Life Sciences Draws Retail Buzz On SLS009 Trial Momentum – Stock Soars In Pre-Market

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)