Advertisement|Remove ads.

Citi Q1 Earnings On Deck: Investors Eye Trading Revenue, Outlook Amid Bullish Retail Mood

Citigroup (C) stock rose marginally in extended trading on Monday, ahead of its first-quarter earnings report, scheduled before Tuesday's opening bell.

According to FinChat data, Wall Street expects the lender to post Q1 earnings of $1.85 per share for the first quarter on revenue of $21.29 billion. Citi has topped estimates in all four previous quarters.

Rivals Wells Fargo, JP Morgan, and Goldman Sachs have topped quarterly earnings estimates, banking on strong trading revenue amid equity market turbulence.

The S&P 500 index fell 4.6% in the first quarter of 2025 after initial optimism around President Donald Trump’s administration began to fade due to the softening of consumer confidence and worries of a recession driven by tariffs.

Investors would also keep a close eye on its investment banking earnings amid a slump in mergers and acquisitions activity amid the market volatility.

Goldman on Monday posted about an 8% drop in investment banking revenue.

Several analysts had cut the price target for the stock after Donald Trump’s initial reciprocal tariff rates, which were significantly higher than expected.

Last week, Trump enacted a 90-day pause on reciprocal tariffs on all countries except China after trillions of dollars worth of wealth were wiped off from U.S. markets.

Trump also exempted certain electronics consumer goods and semiconductors from the tariffs and suggested modifying auto tariffs on Monday.

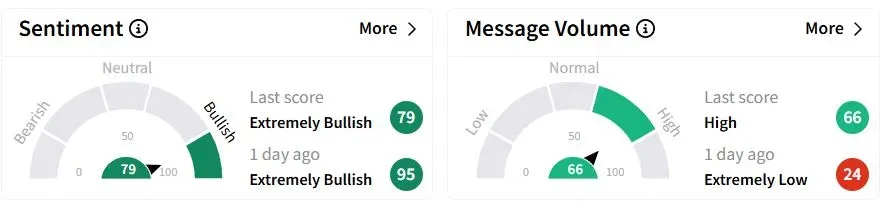

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (79/100) territory but with a lower score than a day ago, while retail chatter rose to ‘high.’

One bullish investor expected a top and bottom-line beat on Tuesday morning.

Citi shares have fallen 10.9% year-to-date (YTD).

Also See: United Airlines Q1 Preview: Outlook Withdrawal On The Cards? Retail Bulls Hold Ground

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)