Advertisement|Remove ads.

United Airlines Q1 Preview: Outlook Withdrawal On The Cards? Retail Bulls Hold Ground

United Airlines (UAL) stock has gained 6.1% over the past week, ahead of its earnings report on Tuesday after the market close.

According to FinChat data, Wall Street expects the airline to post first quarter earnings of $0.80 per share on revenue of $13.18 billion. United has topped estimates in all three previous quarters.

United would be reporting its results at a time when passenger demand is showing signs of a slowdown.

Last week, Delta Airlines and Frontier Group scrapped their full year forecasts as questions linger over the health of the U.S. economy.

The uncertainty around tariffs has raised recession odds in the U.S. Airlines tend to see a drop in earnings during an economic downturn as leisure travel demand weakens.

According to U.S. Transportation Security Administration data, annual growth in passenger traffic fell to 0.7% in March from 5% in January.

Earlier in April, BofA analysts noted that “there’s no place to hide from softening demand trends" for U.S. airline companies, according to The Fly.

Last week, UBS analysts said that tariffs would significantly pressure international travel before adding that the brokerage expects domestic leisure travel weakness and softening corporate travel to intensify, deteriorating revenue in the second quarter and second half of 2025.

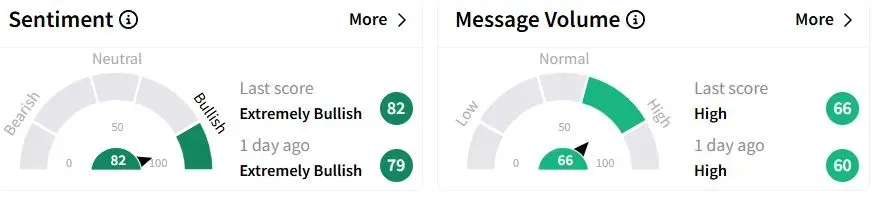

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (82/100) territory, while retail chatter about the stock was ‘high.’

One user hoped for robust results, while another expected a bounce following the earnings report but was cautious about trading the shares before the results.

United Airlines shares have fallen 32.5% year-to-date (YTD).

Earlier this month, the company said it would boost its flying capacity out of San Francisco International Airport by 20% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)