Advertisement|Remove ads.

Citi Stock Rises After Wells Fargo Reiterates ‘Overweight’ Rating Citing Benefits From Trump Tariffs: Retail’s Divided

Citigroup Inc (C) shares traded over 1% higher on Monday after Wells Fargo reportedly reiterated its ‘Overweight’ rating on the stock with a $110 price target.

The price target implies a 58% upside from the stock’s current level.

According to a CNBC report, Wells Fargo believes Citi shares could stand out among banking peers as the Trump administration’s tariffs continue to weigh on markets.

Wells Fargo analyst Mike Mayo noted that Citi is well positioned to navigate any headwinds from the tariffs, given its success navigating the first round of duties during Donald Trump’s first term.

“Citigroup should benefit from tariffs as the company did during Trump 1.0 (Citi is a global intermediary across regions). That’s important at a time when their buybacks could go a lot further at 3/4 of tangible book value,” the analyst said, per the report.

Mayo also noted that Treasury Secretary Scott Bessent might eliminate the red tape and allow banks to make lending decisions. “Deregulation remains the best in three decades for banks, and recent appointments reaffirm a pro-business administration,” the analyst said.

Citi was in the limelight earlier this month after a Bloomberg report said the bank’s wealth management business almost sent $6 billion to a customer’s account — nearly 1,000 times more than what was initially intended.

The report, citing people familiar with the matter, said the error occurred after a staffer copied and pasted the account number into the field instead of the dollar amount to be transferred.

Before that, a Financial Times report said the bank incorrectly credited $81 trillion into a client account instead of transferring just $280.

It elaborated that the transfer was missed by a payments employee and a second official tasked with checking the transaction before approving it to be processed the following business day.

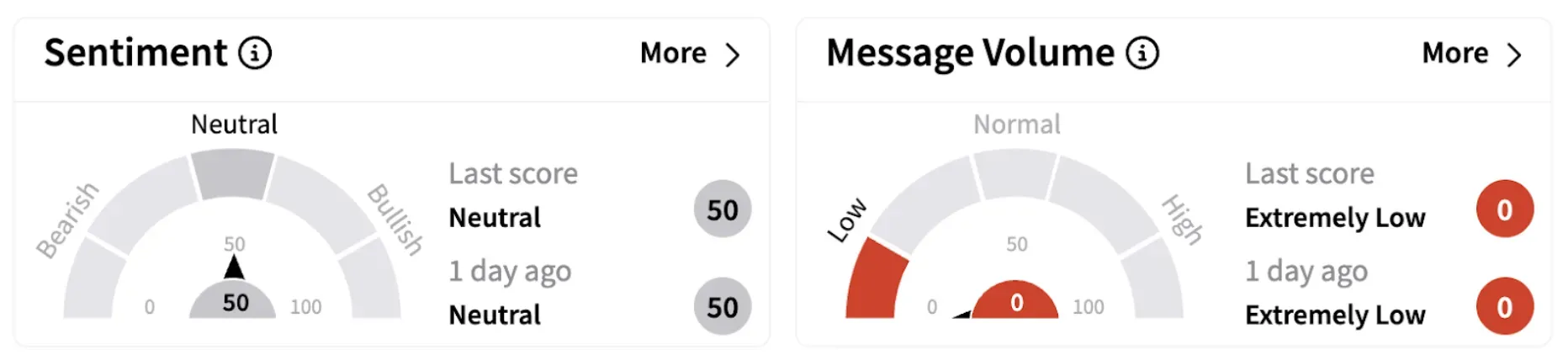

Meanwhile, retail sentiment surrounding Citi continued to trend in the ‘neutral’ territory (50/100).

Recently, Bank of America lowered its target on Citi to $90 from $100 while keeping a ‘Buy’ rating on the shares, according to TheFly.

Citi shares are down nearly 0.44% in 2025 but have gained over 18% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)