Advertisement|Remove ads.

Citi Takes On AmEx Platinum, JPM's Chase Sapphire Reserve With Strata Elite Credit Card: Here's How They Stack Up

Citigroup (C) has launched its Strata Elite credit card, aiming to compete with American Express and JPMorgan Chase for the lucrative high-income customer segment.

The bank charges an annual membership fee of $595 for the card, which is lower than its primary rivals, and offers to unlock $1,500 in value if customers take advantage of the available benefits. In comparison, JPMorgan recently raised the membership fees of its Sapphire Reserve card to $795 from $550, while American Express executives have hinted that its Platinum card fees will be hiked from the present $695.

The Citi card will offer an attractive amount of points for spending in hotels, car rentals, attractions, and dining. The Strata Elite card will also offer a $300 discount on a hotel booking and a $200 annual splurge credit, which can be redeemed at select partners, including Best Buy and Live Nation. Customers will also be able to avail themselves of some benefits provided by Mastercard, Citi’s partner for the card.

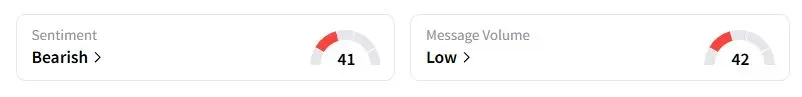

Retail sentiment on Stocktwits about Citigroup was still in the ‘bearish’ territory at the time of writing, while retail chatter was ‘low’ ahead of a fresh trading week filled with Big Tech earnings.

According to a report by The Wall Street Journal, Citi said that the card is designed for cardholders who prefer straightforward access to travel rewards, rather than the increasingly complex offers that require research to unlock.

“Some credit cards have gotten a little lost over time, and it’s a shame,” Pam Habner, head of U.S. branded cards at Citi, reportedly said.

Citi’s arrival in the segment further intensifies competition, which has already been heightened by recent new entrants, including Capital One Financial. Banks are targeting high-income customers, as they are more likely to repay their loans and can also take advantage of other services provided by the lenders.

Citi stock has risen over 35% this year, outperforming the S&P 500 Financials sector’s 10.7% rise. The bank topped Wall Street’s estimates for second–quarter profit earlier this month, after posting an 8% rise in revenue.

Also See: Boeing’s Big Week: Retail Buzz Jumps As Workers Mull Strike, Q2 Print Looms

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)