Advertisement|Remove ads.

CleanSpark Stock Climbs As Bitcoin Miner Blows Past Q1 Earnings Estimate: Retail Cheers

CleanSpark Inc. (CLSK) climbed nearly 7% in pre-market trading on Friday after the Bitcoin miner reported first-quarter earnings that surpassed analyst expectations.

The company posted earnings per share of $0.83, the consensus estimate of $0.17 by $0.66.

Revenue came in at $162.3 million, surpassing Wall Street’s forecast of $153.06 million and marking a 120% year-over-year increase.

Net income for the quarter rose sharply to $246.8 million, compared to $25.9 million in the same period last year.

If pre-market gains hold, CleanSpark shares will have erased weekly losses.

CleanSpark CEO Zach Bradford credited operational improvements for the company’s strong quarter, citing gains in key industry metrics such as operating hashrate, fleet efficiency, and bitcoin treasury growth.

“We exceeded 2024 guidance and surpassed 40 EH/s in January while reducing fleet efficiency to 16.15 J/Th,” Bradford said. “CleanSpark delivered $162.3 million in revenue at a marginal cost to mine of approximately $34,000 per bitcoin for the quarter.”

Bradford added that the company remains on track to reach 50 EH/s in the first half of 2025 through expansion in Wyoming, Tennessee, and Georgia.

CleanSpark CFO Gary Vecchiarelli pointed to the company’s improving financial position, highlighting a recently closed $650 million convertible bond and the completion of its at-the-market offering program.

“We overcame virtually all of the halving impact on the Bitcoin block subsidy while growing our bitcoin treasury to over 10,500 — 100% of which was self-mined in the U.S.,” Vecchiarelli said.

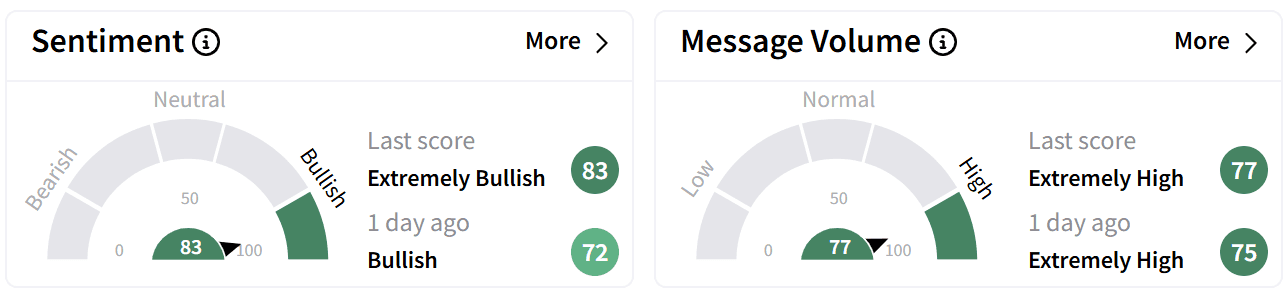

On Stocktwits, retail sentiment around Cleanspark improved to ‘extremely bullish’ from ‘bullish’ ahead of the earnings as chatter remained at ‘extremely high’ levels.

One user commented that while the earnings were good, the jobs report later in the day along with the expiring options at the end of the month, could result in a volatile day for the stock.

Another said that while there could be a “pop and drop”, the stock could eventually rise to $15.

CleanSpark ended the quarter with working capital of $1.2 billion, including $50 million in available credit secured by bitcoin holdings.

The company reported a 57% gross margin, nearly $2.8 billion in total assets, and $1.2 billion in total liquidity.

CleanSpark’s stock has jumped nearly 10% so far this year, outpacing Bitcoin’s gains of 4.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)