Advertisement|Remove ads.

Why Did Cleveland-Cliffs Stock Plummet 11% On Thursday?

- CLF announced pricing of its public offering of 75 million shares through which it expects to raise $964 million.

- The company also announced details of the deal with South Korea’s POSCO

- The partnership, strengthened by the new US-South Korea trade agreement, aims to expand POSCO’s customer base in the U.S.

Shares of Cleveland-Cliffs Inc. (CLF) tumbled over 11% on Thursday, after the company announced the pricing of its public offering of 75 million shares through which it expects to raise $964 million on a gross basis.

The company priced 75 million shares at $12.85 each, which is lower than Wednesday’s closing price of $14.09. The steelmaker will use the proceeds to repay borrowings under its asset-based credit facility and for general corporate purposes.

UBS Securities, the sole underwriter for the offering, has been given an additional 30-day option to purchase 11.25 million shares.

MoU With POSCO

Separately, Cleveland-Cliffs unveiled the details of a memorandum of understanding (MoU) with South Korea’s POSCO. The partnership, strengthened by the new US-South Korea trade agreement, aims to expand POSCO’s customer base in the U.S. Cleveland-Cliffs expects the collaboration to be highly accretive to shareholders, with a definitive agreement anticipated by early 2026 and closing expected later that year.

The deal also represents a shift in strategy for Cleveland-Cliffs’ CEO Lourenco Goncalves, who previously opposed US Steel’s sale to Japan’s Nippon Steel, arguing for the protection of domestic ownership in the U.S. steel industry.

How Did Stocktwits Users React?

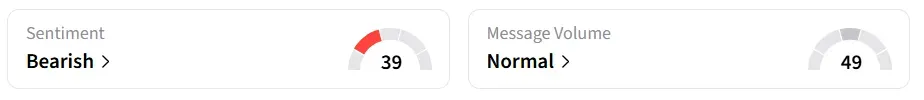

Retail sentiment has remained ‘bearish’ since flipping from ‘extremely bullish’ last week.

One user said the stock was “artificially high”, and it is a good time for management to dilute their shares.

However, another user saw the benefits in the company clearing off some of its debt.

Year-to-date, CLF’s stock has gained nearly 31%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)