Advertisement|Remove ads.

Cloudflare Stock Dips On Baird Downgrade Flagging Overvaluation: Retail Shrugs It Off

Shares of Cloudflare Inc. (NET) fell nearly 4% in morning trade on Monday as analysts at Baird identified some near-term risks to high-multiple names.

According to TheFly, Baird analysts underscored that 2025 could bring some prudence as far as the growth outlook for security stocks is concerned.

Baird downgraded the Cloudflare stock to ‘Neutral’ from ‘Outperform’ while raising the price target to $140 from $125. This implies an upside of a little over 4% from current levels.

They would prefer to take a more balanced risk-to-reward profile, pointing to the possibility of initial expectations being reset lower.

The brokerage observed that existing multiples are already at historically high premiums, which doesn’t afford security stocks with a lot of room to rise further this year.

Last week, analysts at Wells Fargo upgraded their price target for the Cloudflare stock to $150 while maintaining an ‘Overweight’ rating on the company’s shares.

Cloudflare is set to announce its fourth-quarter results on Feb. 13.

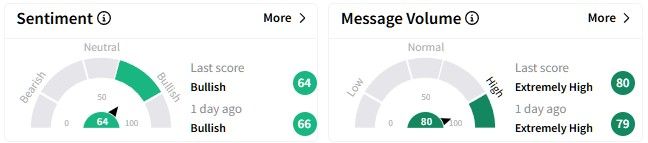

Retail sentiment on Stocktwits remained in the ‘bullish’ (64/100) territory despite the downgrade. Message volume surged, hovering at ‘extremely high’ levels at the time of writing.

Some users on the platform are not sold on the cautious approach of Baird analysts.

Cloudflare stock price has surged more than 71% over the past six months, while its one-year performance has been relatively less stellar, with gains of 65%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)