Advertisement|Remove ads.

Coca-Cola Eyes Strong Q2 Report As Analysts Flag Positive Demand Trends, International Market Strength

Shares and investor sentiment for Coca-Cola (KO) rose ahead of the company's second-quarter earnings report on Tuesday, with analysts forecasting a strong performance.

RBC said it expects "strong organic growth" in both its domestic and global markets, led by its Latin America and Europe, the Middle East, and Africa (EMEA) regions.

Favorable foreign exchange trends are also helping to mitigate the impact of higher aluminum tariffs, RBC added.

Coca-Cola is part of Morgan Stanley's top picks in the beverages category, and the research firm expects sales growth to exceed that of its peers and consensus, driven by stronger pricing power, solid historical volume growth, sustained share gains, and a benign competitive environment.

Last week, PepsiCo reported better-than-expected quarterly results, driven by strength in its international markets and some improvement in its struggling North America business.

Coca-Cola is expected to report a 2.1% rise in revenue to $12.6 billion, according to the analysts' consensus estimate from Koyfin. The company has posted single-digit percentage growth in nine of the last 10 quarters, and a decline in Q1.

Adjusted profit is expected to be $0.84, the same as in Q2 2024.

Coca-Cola shares were up nearly 1% in premarket trading, after gaining 0.3% in Monday's session. The stock is up 12.5% year-to-date.

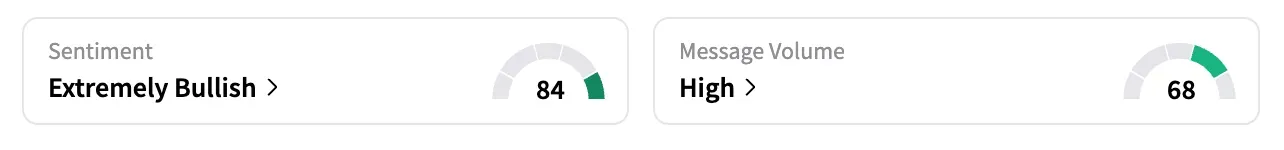

On Stocktwits, retail sentiment for KO shifted to 'extremely bullish' as of the time of writing, from 'bullish' 24 hours ago, while the message volume was 'high.'

In its last quarterly report in April, the company beat estimates for revenue and profit, thanks to price hikes and strong demand for its sodas.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Tesla's 'Retro-Futuristic' Diner Is Finally Open In LA: Here’s What It Offers

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)