Advertisement|Remove ads.

Coca-Cola, Philip Morris, Cal-Maine Earnings In Focus, Retail Investors Fizz Up

Retail sentiment on consumer stocks, including Coca-Cola, Philip Morris, and Cal-Maine Foods, remained unchanged on Stocktwits heading into earnings on Tuesday, as investors brace for results amid tariff-driven macroeconomic uncertainty under President Donald Trump, which has weighed on consumer sentiment.

The S&P 500 (SPX) hit a new record high during early trading on Monday, as major consumer and tech-focused companies report their quarterly earnings this week. Here are the top three consumer companies reporting on Tuesday:

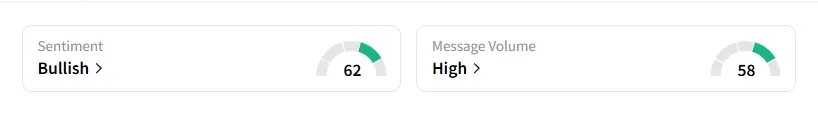

1. Coca-Cola (KO): Retail sentiment on the stock remained unchanged and in the ‘bullish’ territory with chatter volumes at ‘high’ levels, according to Stocktwits data.

The soda giant’s shares were marginally up in early trading and have gained nearly 13% year-to-date. Retail user messages on Stocktwits for Coca-Cola saw a 125% in the last seven days.

In April, the company had flagged that demand could take a hit from the tariffs despite strong demand for its soda and juices.

The company is expected to post second-quarter net revenue of $12.56 billion, a 7% rise year-over-year, and earnings per share of $0.84, according to data compiled by Fiscal AI.

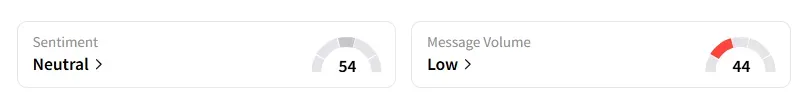

2. Philip Morris (PM): Retail sentiment on the tobacco company remained in the ‘neutral’ territory with chatter at ‘low’ levels, according to Stocktwits data.

Philip Morris’ shares were up nearly 1% and have gained 50% year-to-date.

In early July, brokerage Citigroup noted that the company's second-quarter results should deliver an "impressive delivery" across its businesses and expects strong ZYN volumes, as well as a robust contribution from IQOS and combustibles.

Philip Morris’ net revenue is expected to rise 12.4% to $10.33 billion, and earnings per share are estimated to be $1.86.

3. Cal-Maine Foods (CALM): Retail sentiment on the stock was unchanged and remained ‘neutral’ while chatter levels were ‘high,’ according to data from Stocktwits.

Cal-Maine Foods shares were up about 3% in early trading and have seen a 6% rise year-to-date.

Last week, Stephens raised its price target on Cal-Maine Foods to $108 from $97, according to TheFly, noting that egg fundamentals remain healthy, supported by limited supplies and stronger-than-usual summer demand.

Cal-Maine’s net revenue is expected to rise 38.4% to $903.1 million, and profit is estimated to be $5.17.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)