Advertisement|Remove ads.

Coca-Cola Stock Rises Ahead Of Q4 Earnings: Retail Stays Cautious

Shares of Coca-Cola ($KO) have risen 1.8% in the past five days ahead of the beverage giant’s fourth-quarter results, with retail sentiment staying cautious.

Wall Street analysts expect Coca-Cola to post earnings per share of $0.52 on revenue of $10.68 billion, according to Stocktwits data.

Recently, Jefferies upgraded Coca-Cola to ‘Buy’ from ‘Hold’ with a price target of $75, up from $69, Fly.com reported, noting Coca-Cola's Q4 to be a "clearing event, bringing in a wave of investors looking for quality at a fair price."

According to the firm, the business is in "great shape" with its volumes compounding and its cash flow about to inflect "meaningfully." Even as the strength in the US Dollar revises 2025 numbers lower, the impact is only two cents on earnings per share, priced in at current share levels, added the report citing the analyst who also remarked Coca-Cola's Q4 to be a "clearing event, bringing in a wave of investors looking for quality at a fair price."

UBS lowered the firm's price target on Coca-Cola to $72 from $82 with a ‘Buy’ rating, based on sentiment around consumer staples being bearish despite underperforming the broader market by nearly 50% over the last two years, Fly.com reported.

While Piper Sandler began coverage of Coca-Cola with an ‘Overweight’ rating last month, with a $74 price target. According to the firm, Coca-Cola is poised to benefit from beverage categories catching attracting tailwinds globally and rising incomes in emerging markets.

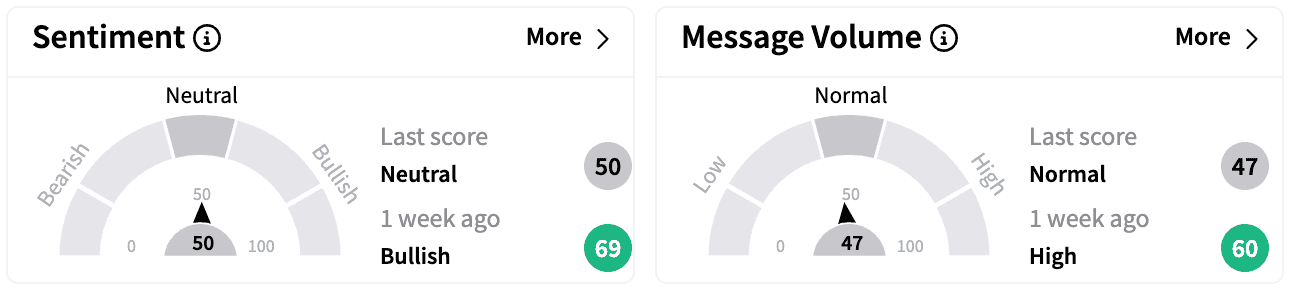

Sentiment on Stocktwits turned ‘neutral’ from ‘bullish’ a week ago with some users expressing caution following Robert F. Kennedy's stance on packaged goods and sugar-laden beverages. Message volumes moved into the ‘normal’ zone from ‘high.’

Coca-Cola beat earnings and revenue estimates in all four quarters last year. For the third quarter, its net revenues declined 1% to $11.9 billion, and organic revenues grew 9%.

“Our business continues to demonstrate resilience in the face of a dynamic external environment,” said James Quincey, chairman and CEO of Coca‑Cola said after its Q3 results “We are encouraged by our year-to-date performance and our system’s ability to manage near-term challenges while also remaining focused on long-term growth opportunities.”

Coca-Cola portfolio includes Coca-Cola, Sprite and Fanta. Its water, sports, coffee and tea brands include Dasani, smartwater, vitaminwater, Topo Chico, Bodyarmor, Powerade, and Costa.

Coca-Cola stock is up 2.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)