Advertisement|Remove ads.

New Gold Stock Rises 10%, Retail Traders Turn Upbeat As Coeur Mining Announces $7B Acquisition

- Shares of New Gold surged over 10%, while Coeur Mining’s stock was down 5.8%

- Coeur will own 62% of the company while New Gold shareholders will hold the remaining 38%.

- The combined entity will operate seven mines

Shares of New Gold Inc. (NGD) surged over 10% in premarket trade on Monday, after the company announced that Coeur Mining, Inc. (CDE) will acquire the company for around $7 billion.

Coeur Mining’s shares were down 5.8% at $16.6.

Under the terms of the agreement, New Gold shareholders will receive 0.4959 Coeur shares for each New Gold share, representing a 16% premium to New Gold’s closing price on October 31. The merger will create a North America-focused precious metals producer with an estimated market capitalization of $20 billion.

Coeur will own 62% of the company while New Gold shareholders will hold the remaining 38%.

Forming A $20 Billion Powerhouse

The new company will operate seven mines, producing around 1.25 million gold-equivalent ounces (GEO) annually, including 900,000 ounces of gold and 20 million ounces of silver.

The expected EBITDA for 2026 is $3 billion, and the free cash flow of $2 billion will more than double Coeur’s current projections, strengthening its balance sheet and supporting a potential investment-grade rating. The deal is accretive to all key financial metrics.

The stronger financial position will enable increased investments in high-return growth projects, including New Afton’s K-Zone, Rainy River expansion, and exploration across Coeur’s U.S., Mexico, and Canadian assets.

Upon completion, Coeur CEO Mitchell J. Krebs will lead the combined company, with New Gold CEO Patrick Godin joining Coeur’s board. The transaction is expected to close in the first half of 2026.

Stocktwits Users Buoyant

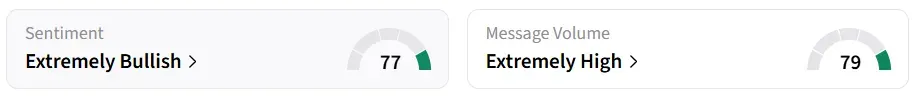

NGD’s retail investors on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a session earlier. Chatter was ‘extremely high’.

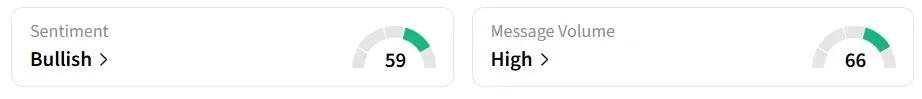

Despite the premarket declines, retail sentiment for CDE remained ‘bullish’.

Both stocks have seen significant buying interest so far in 2025, gaining around 193%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)