Advertisement|Remove ads.

Conduit Pharma Stock Drops On Reverse Stock Split Announcement: Retail’s Pessimistic

Shares of Conduit Pharmaceuticals Inc. (CDT) dropped 5% on Friday morning after the company’s board approved a 1-for-15 reverse stock split of its common stock.

Earlier, shareholders approved the stock split proposal in a meeting on May 5, leaving it upon the board to determine the exact split ratio.

The company said the reverse stock split will become effective on May 19 at 5:00 p.m. ET, and the stock will start trading on a reverse stock-split adjusted basis at market open on May 20.

On May 19 evening, every 15 shares of the firm’s issued and outstanding common stock will be combined into one share, reducing the number of outstanding shares of common stock to about 755,900.

The company said no fractional shares will be issued in connection with the split, and those entitled to a fractional share will instead receive a proportional cash payment.

Earlier this month, the company flagged doubts regarding its ability to continue as a going concern for at least the next 12 months.

It said management has determined it does not have sufficient cash and other sources of liquidity to fund its current business plan, adding that it had cash and cash equivalents of only $2.1 million as of the end of the first quarter.

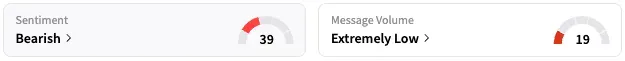

On Stocktwits, retail sentiment around Conduit Pharmaceuticals remained unmoved within the ‘bearish’ territory over the past 24 hours while message volume remained at ‘extremely low’ levels.

A Stocktwits user, however, expressed skepticism about the stock’s performance.

The shares closed at over $1 last in early April.

CDT stock is down 95% this year and has lost nearly all of its value over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)