Advertisement|Remove ads.

ConocoPhillips Q1 Profit Beats, But CEO Signals Industry-Wide Activity Cuts Amid Soft Oil Prices: Retail’s Split

ConocoPhillips (COP) stock gained 1.3% on Thursday after the company topped Wall Street’s estimates for first-quarter earnings.

On an adjusted basis, the company reported earnings of $2.09 per share for the three months ended March 31, while analysts expected it to post $2.05 per share, according to FinChat data.

The oil and gas producer’s quarterly revenue of $17.10 billion also beat the average analysts’ estimate of $15.91 billion.

Its first-quarter production rose to 2.39 million barrels of oil equivalent per day (boe/d), a 487,000 boepd rise compared to a year earlier, aided by strong output from the Permian basin.

During the fourth quarter, ConocoPhillips completed its $22.5 billion deal to buy Marathon Oil to bolster its output.

Its total average realized price was $53.34 per boe, a 6% decline from a year earlier due to lower oil prices.

Like its peer, Occidental Petroleum, the company lowered its 2025 capital expenditure outlook to the range of $12.3 billion to $12.6 billion, compared to its prior forecast of approximately $12.9 billion.

U.S. oil producers are reining in spending as oil prices have fallen since April on concerns over a recession triggered by trade wars and OPEC+ oversupply.

Its CEO, Ryan Lance, said that while balance sheets across the industry are in better shape than before the previous downturn, shale drillers could rapidly reduce drilling activity if prices drop to the low $50s.

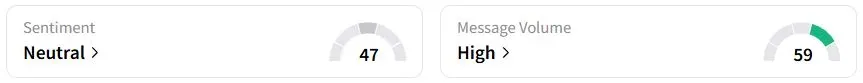

Retail sentiment on Stocktwits was in ‘neutral’ (47/100) territory, while retail chatter was ‘high.’

ConocoPhillips stock has fallen 11.2% year to date (YTD) compared to a 3.5% fall in the S&P 500 index.

Also See: Japan's Exports Dip As Trump Tariff Threats Loom, Lutnick Signals Trade Deal Delay

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)