Advertisement|Remove ads.

ConocoPhillips Stock Gets Downgrade, Price Target Cut By Raymond James: Retail’s Unimpressed

ConocoPhillips (COP) garnered retail attention on Monday after Raymond James downgraded the stock to ‘Outperform’ from ‘Strong Buy.’

According to TheFly, Raymond James also cut the price target of the oil producer’s stock to $124 from $157. The new price target implies a 26% upside compared to the stock’s last close.

The brokerage said that although ConocoPhillips remains one of the best-run exploration and production (E&P) firms with an impressive global asset portfolio and an attractive valuation, it lacks any near-term catalyst.

In January, the U.S. Energy Information Administration (EIA) had forecast a drop in crude oil prices in 2025. It expects strong global growth in petroleum and other liquids production and slower demand growth to put downward pressure on prices.

According to the EIA, this could offset heightened geopolitical risks and voluntary production restraint from (full form needed) OPEC+ members.

ConocoPhillips’ earnings topped Wall Street estimates last week due to strong growth in oil production.

The company expects 2025 production to average between 2.34 million to 2.38 million barrels of oil equivalent per day (boe/d), which includes a 20,000 boe/d impact from planned maintenance.

ConocoPhillips also set a target of $10 billion for shareholder returns in 2025. In 2024, it spent $9.1 billion on buybacks and dividends.

However, Barclays analysts said that with ConocoPhillips’ significant capital spending expected to decrease every year after 2025, the company offers one of the most visible free cash flow growth stories in its coverage through the decade's end.

According to TheFly, the firm expects the oil producer’s shares to remain attractively valued.

Its shares were up marginally in morning trade on Monday.

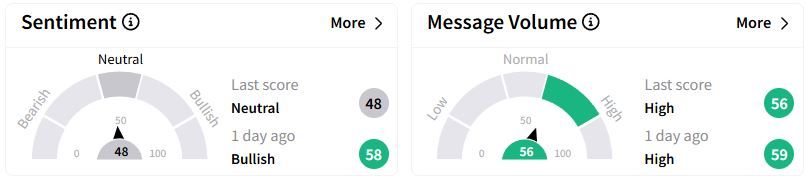

Retail sentiment on Stocktwits moved to ‘neutral’ (48/100) territory from ‘bullish’(58/100) a day ago, while retail chatter was ‘high.’

Over the past year, ConocoPhillips stock has fallen 10.7%.

Also See: BP Stock Rises Premarket On Reports Of Activist Investor Elliott Taking A Stake: Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)