Advertisement|Remove ads.

ConocoPhillips Tops Q4 Earnings On Strong Oil Production: Retail’s Unswayed

ConocoPhillips (COP) stock was on the retail radar after the company’s fourth-quarter earnings beat Wall Street estimates on Thursday.

On an adjusted basis, the company reported a net income of $2.4 billion, or $1.98 per share, for the three months ended Dec. 31, compared with an analyst estimate of $1.83 per share, according to FinChat data.

The oil and gas producer’s quarterly revenue of $14.74 billion also beat average analysts’ estimate of $14.22 billion.

Its fourth-quarter production rose 14.8% to 2.18 million barrels of oil equivalent per day (boe/d), aided by strong output from the Permian basin.

During the fourth quarter, the company began production from Nuna in Alaska and the Bohai Phase 5 project in China.

According to the latest U.S. Energy Information Administration projections, U.S. oil production likely hit a new record in 2024, as technological advancements have helped producers raise their output by drilling longer.

The firm’s total average realized price fell 10% to $52.37 per boe, as a fall in oil prices offset an uptick in production.

ConocoPhillips expects 2025 production to average between 2.34 million to 2.38 million boe/d, which includes a 20,000 boe/d impact from planned maintenance.

During the fourth quarter, ConocoPhillips completed its $22.5 billion deal to buy Marathon Oil, which would help boost its 2025 production.

The Houston-based oil producer projected capital expenditures of about $12.9 billion this year.

The company set a target of $10 billion for shareholder returns in 2025. In 2024, it spent $9.1 billion on buybacks and dividends.

The stock was marginally down in morning trade.

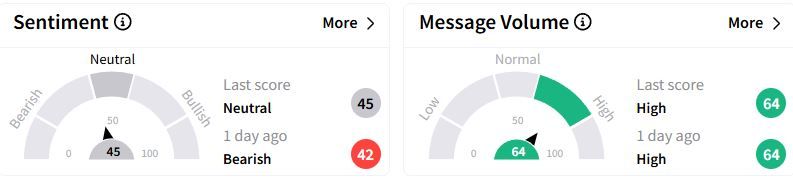

Retail sentiment on Stocktwits moved higher into ‘neutral’ (45/100) territory from ‘bearish’(42/100) a day ago, while retail chatter was ‘high.’

In January, larger peer Exxon Mobil had topped Wall Street estimates while Chevron’s profit fell short.

Over the past year, ConocoPhillips shares have fallen 9.9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)