Advertisement|Remove ads.

BP Stock Rises Premarket On Reports Of Activist Investor Elliott Taking A Stake: Retail’s Bullish

BP Plc (BP) stock rose 6.7% in premarket trade on Monday and remained on track to open at its highest since August, on reports that Elliott Investment Management has built a stake in the oil major.

Bloomberg News reported on Saturday that Elliott’s stake in BP was “significant” and that the activist investor believed that BP is ‘significantly undervalued and its performance is disappointing.’

The report added, citing people familiar with the matter, that Elliott would push the British energy firm to consider transformative measures.

Elliott, founded by hedge fund manager Paul Singer, has pushed for changes in several energy firms in recent years, including U.S. utility NRG Energy and Canada’s Suncor Energy.

Elliott recently nudged Honeywell to split into three independent companies after unveiling a $5 billion stake.

Till Friday’s close, BP’s valuation was less than half of its London-listed rival Shell.

Last year, CEO Murray Auchincloss pledged to cut the company’s costs by $2 billion by the end of 2026.

Auchincloss has also looked to refocus on oil and gas investments and slowed down renewable energy operations.

In January, the company had agreed to lay off around 4,700 employees in 2025 to rein in costs.

BP will hold its capital markets day on Feb. 26 in London.

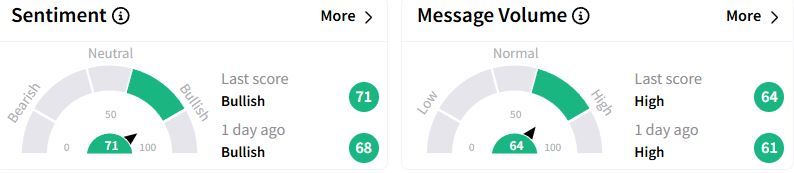

Retail sentiment on Stocktwits moved higher in ‘bullish’ (71/100) territory than a day ago, while retail chatter was ‘high.’

One user expressed joy that others are finally seeing the company’s value.

BP is scheduled to report its fourth-quarter results on Tuesday.

The company had flagged lower fourth-quarter production and weaker earnings due to lower commodity prices in January.

Over the past year, BP’s U.S. shares have fallen 10.8%, while Exxon and Shell have gained 6.5% and 4.1%, respectively.

Also See: FactSet Stock Rises On $246.5M Acquisition Of LiquidityBook: Retail Enthusiasm Soars

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)