Advertisement|Remove ads.

ConocoPhillips Stock Falls After Company Discloses $735M Asset Sale To Shell: Retail Eyes Rally

ConocoPhillips (COP) shares traded over 2% lower on Friday after the company disclosed it has agreed to sell its interests in the Ursa and Europa Fields and Ursa Oil Pipeline Company to Shell for $735 million.

ConocoPhillips said the transaction also includes an overriding royalty interest in the Ursa Field and that the company intends to use the proceeds from the transaction for general corporate purposes.

Andy O’Brien, senior vice president of strategy, Commercial, Sustainability & Technology at the company, said combined with previously announced dispositions, the transaction reflects the firm’s commitment to strengthen its portfolio by divesting non-core assets and shows progress toward its $2 billion disposition target.

ConocoPhillips is an exploration and production company with operations and activities in 14 countries and $123 billion of total assets.

The company has 15.96% interest in the Ursa Field and 1% interest in the Europa Field. The full-year production associated with these interests amounts to approximately 8,000 barrels of oil equivalent per day (MBOED). ConocoPhillips expects the transaction to be completed by the end of second quarter of 2025.

For the fourth quarter, the company announced adjusted earnings per share (EPS) of $1.98 compared to a Wall Street estimate of $1.83.

The company’s 2025 production guidance stands at 2.34 to 2.38 MMBOED, which includes impacts of 20 MBOED from planned turnarounds.

First-quarter 2025 production is expected to be 2.34 to 2.38 MMBOED, which includes impacts of 20 MBOED from January weather and 5 MBOED from turnarounds.

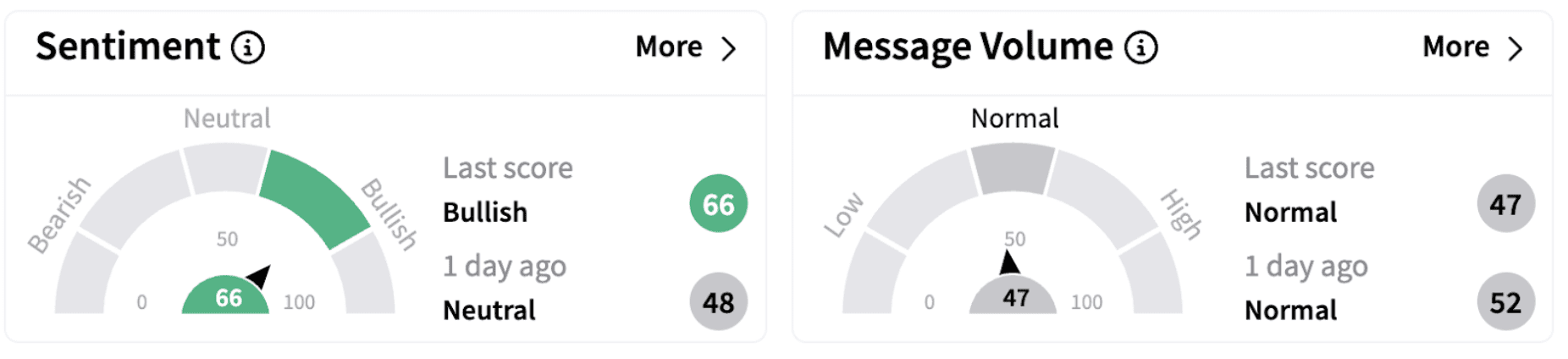

On Stocktwits, retail sentiment flipped into the ‘bullish’ territory (66/100) from ‘neutral’ a day ago.

One Stocktwits user expects the shares to hit the $110 mark in the coming times.

ConocoPhillips shares have lost nearly 0.5% in 2025 and are down almost 12% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)