Advertisement|Remove ads.

Arbor Realty Stock Stares At Worst Single-Day Decline In 7 Months On Lower Distributable Earnings: Retail Eyes Bottom-Fishing Opportunity

Arbor Realty Trust Inc (ABR) shares tumbled over 13% on Friday, headed toward their worst single-day session since July 12, 2024, after the real estate investment trust disclosed a dip in its fourth-quarter distributable earnings.

Distributable earnings for the quarter declined 22% year-over-year (YoY) to $81.6 million, or $0.40 per diluted common share, compared to $104.1 million, or $0.51 per diluted common share for the quarter ended Dec. 31, 2023.

Net interest income (NII) fell 20% to $82.87 million during the quarter, while net income declined 35% to $59.8 million or $0.32 per diluted common share. Arbor’s Agency Business revenues rose marginally to $78.7 million year-over-year.

During the quarter, the company recorded a $3.4 million provision for loan losses associated with CECL. Arbor modified fifteen loans with a total unpaid principal balance (UPB) of $466.6 million – the vast majority of which had borrowers investing additional capital to recapitalize their deals.

Arbor said it had 26 non-performing loans with a UPB of $651.8 million before related loan loss reserves of $23.8 million. This compares with 26 loans with a UPB of $625.4 million before loan loss reserves of $37.3 million as of Sept. 30, 2024.

Arbor’s Board of Directors has declared a quarterly cash dividend of $0.43 per share of common stock, payable on March 21, 2025, to common stockholders of record on March 7, 2025.

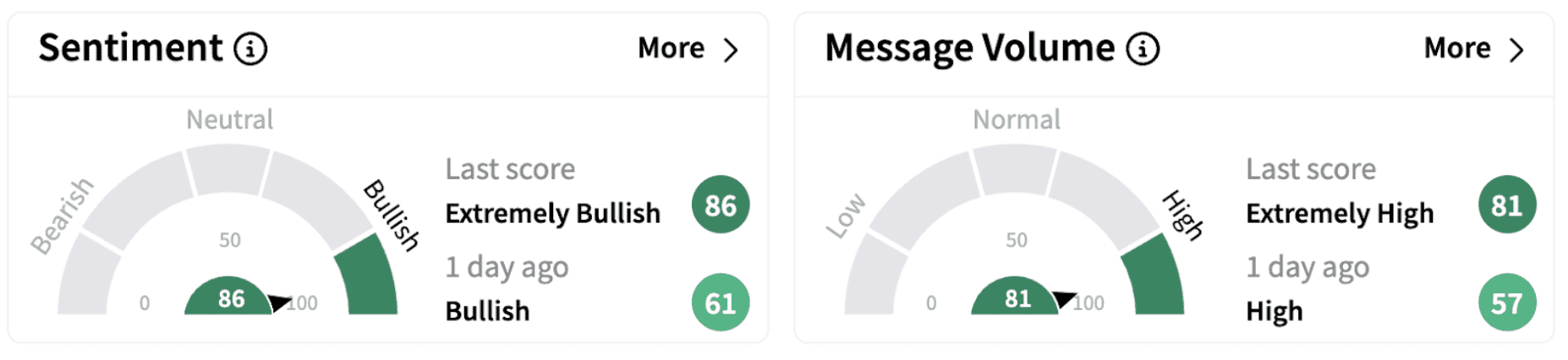

Despite the decline in stock price, retail sentiment on Stocktwits climbed into the ‘extremely bullish’ territory (86/100) from ‘bullish’ a day ago, accompanied by significant retail chatter.

Many Stocktwits users felt the current dip provides a good buying opportunity.

Arbor stock has declined over 11% in 2025 and is down over 6% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)