Advertisement|Remove ads.

Consolidation In Adani Green May Signal Base Formation Ahead Of Q1 Earnings: SEBI RA Rohit Mehta

Adani Green Energy is showing signs of consolidation ahead of its first-quarter earnings scheduled later in the day.

Adani Green Energy shares have corrected over 68% from their all-time high of ₹3,050 in April 2022. However, the stock is now showing signs of base formation, as observed by SEBI-registered analyst Rohit Mehta.

After bouncing off its long-term support zone between ₹750 - ₹900, it is currently consolidating, the analyst noted.

A breakout above ₹1,250 - ₹1,300 could signal the beginning of a new trend reversal, although the broader structure remains bearish unless this resistance is breached decisively, Mehta added.

Fundamentally, the company has its strengths, especially a massive 127% CAGR in profits over the last five years and improved debtor days. However, high valuations of 12.7x book value, low dividend payout, and a weak interest coverage ratio remain key concerns.

The company’s low effective tax rate raises questions and may require closer examination for transparency. Additionally, the potential capitalization of interest costs could be inflating reported profits, the analyst said.

Investors will be closely watching the company’s earnings momentum. In the previous quarter, Adani Green reported robust revenue growth of 21.6% and a 31% increase in operating profit. While profit before taxes surged over 40% sequentially, EPS declined 53.6%, indicating some earnings pressure.

Promoters increased their stake to 61.91% as of June 2025, while foreign investors (FII) trimmed exposure to 11.58%. Domestic investors (DIIs), on the other hand, increased their stake to 2.86%.

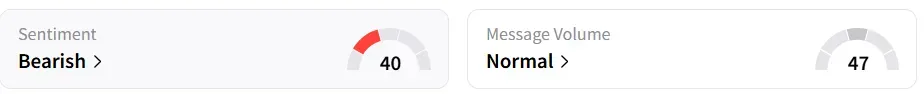

Retail sentiment on Stocktwits remained ‘bearish’. It was ‘bullish’ a year ago.

The stock was up 0.9% at ₹984.40 in early trade on Monday, having shed nearly 6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)