Advertisement|Remove ads.

Constellium Stock Edges Lower On Weak Outlook For 2025 After A Mixed Q4: Retail Sentiment Declines

Shares of Constellium SE (CSTM) edged lower in after-hours trading as the company reported mixed fourth-quarter results.

Wall Street analysts expected earnings per share (EPS) of $0.04 in Q4, but the company reported a net loss of $0.34 per share. In the same period last year, the company reported an EPS of $0.02 per share.

Constellium posted revenue of $1.72 billion in Q4. While it was down 1% year over year, it beat the consensus estimate of $1.61 billion.

For fiscal year 2024, Constellium reported revenue of $7.3 billion and a net income of $60 million, down from $7.8 billion and $157 million recorded in 2023.

"2024 was a very challenging year for Constellium on many fronts," said CEO Jean-Marc Germain, pointing to severe weather events like extreme cold and snow disruption operations at its Muscle Shoals facility in January, to severe floods at its facilities in the Valais region in Switzerland.

Constellium’s earnings before interest, taxes, depreciation, and amortization (EBITDA) came in at $623 million. The company remained cautious about its prospects in 2025, guiding for an EBITDA between $600 million and $630 million.

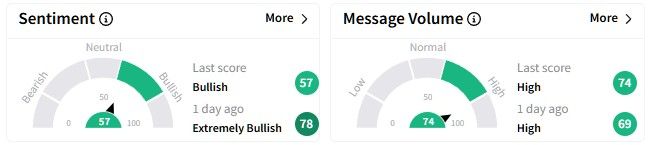

Retail sentiment on Stocktwits around the Constellium stock declined, entering the ‘bullish’ (57/100) territory from ‘extremely bullish’ (78/100) a day ago.

Message volumes were at ‘high’ levels at the time of writing.

Data from FinChat shows the average price target for the CSTM stock is $18.09, implying an upside of nearly 75% from current levels. Data shows there are two recommendations each with ‘Buy’, ‘Outperform’, and ‘Hold’ ratings.

Constellium’s stock has been on a downtrend recently, declining by over 36% in the past six months. Its performance over the past year has been worse, with a fall of nearly 47%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)