Advertisement|Remove ads.

CoreWeave Retail Investors Guarded After 170% Rally Takes Stock Past $100: Stocktwits Poll

Data center operator and Nvidia (NVDA) partner CoreWeave, Inc.’s (CRWV) shares have been on a roll in recent sessions, and following the run-up, retail investors’ optimism regarding the stock has tempered.

On Wednesday, CoreWeave stock bucked the broader market weakness and settled 19% higher, as investors cheered the company raising $2 billion through a senior note offering.

The offering was upsized from the previously planned $1.5 billion, reflecting confidence in the company.

CoreWeave, which went public on March 28 at an initial public offering price (IPO) of $40 per share, crossed the $100 psychological resistance on Wednesday before settling at $107.39.

A positive commentary from Citigroup also underpinned sentiment. The firm nearly doubled its stock price target, citing positive first-quarter headline numbers and the guidance.

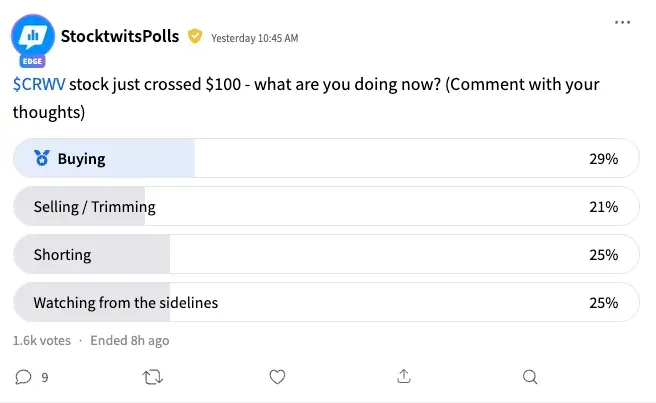

A Stocktwits poll that asked users what they were doing as CoreWeave stock crossed the $100 threshold found that 29% were buying the stock. Over one-fifths (20%) said they sold/trimmed CoreWeave positions.

One-fourth (25%) are shorting the stock, while a similar proportion just wants to watch from the sidelines.

The poll received responses from 1,600 respondents.

A user who clarified his stance said the CoreWeave stock was in “oversold” territory. “There just doesn’t seem to be enough likely upside potential to make getting in at this point worth the risk,” they added.

Another respondent said they sold their holding for a big profit on Tuesday and are now waiting to return to the stock after the short squeeze ends. The short interest in the stock is about 2.50%, according to Koyfin.

One, who identified as bullish on the stock said, “I am patting myself on the back for buying when I did!! Holding & watching.”

CoreWeave stock has risen nearly 170% since its late-March debut. Sell-side analysts are wary of any further upside. The Koyfin-compiled consensus price target of $65 implies a nearly 40% downside from Wednesday’s close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Ryan Reynolds-Backed Ad Tech Firm MNTN Prices $187M IPO At Top End Of Estimated Range

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)