Advertisement|Remove ads.

CoreWeave Shares Surge After Nvidia Reveals 7% Stake: Retail’s Exuberant

CoreWeave Inc.(CRWV) shares shot up over 10% on Friday morning, following a significant disclosure by one of its most prominent backers, Nvidia Corp. (NVDA).

Nvidia revealed late Thursday that it has acquired a 7% stake in CoreWeave, amounting to approximately 24.2 million shares, according to a 13G document filed with the U.S. Securities and Exchange Commission.

The investment reflects Nvidia’s interest in bolstering its influence in the high-performance computing and AI infrastructure space.

CoreWeave operates as a cloud provider specializing in GPU-based workloads, a sector that closely aligns with Nvidia’s core business and strategic goals in AI acceleration.

CoreWeave has quickly emerged as a key player in the AI cloud market, securing major deals and funding rounds amid growing demand for AI compute power.

In a recent SEC filing, the company disclosed a $4 billion contract with OpenAI. This agreement follows an earlier $12 billion partnership between the two companies, unveiled in March before CoreWeave’s IPO.

In its maiden earnings report, CoreWeave posted revenue of $981.63 million, up 420% year over year (YoY), and the adjusted loss per share was $0.61.

During the first quarter (Q1) earnings call, the company said it deployed NVIDIA’s H100 and H200 GPUs at scale and was also the first to offer GB200 NVL72 instances for general use. In addition, the company began to generate Blackwell-related revenue in Q1.

Additionally, Coreweave’s MLPerf Inference v5.0 was the first to use NVIDIA’s GB200 Grace Blackwell Superchips.

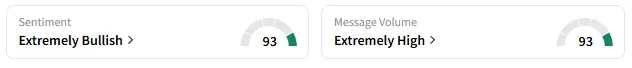

On Stocktwits, retail sentiment around CoreWeave remained ‘extremely bullish’.

A bullish Stocktwits user called the stock ‘appealing’.

Since its debut as a public company in late March, CoreWeave stock has gained 81%.

Also See: Microsoft Edges Toward EU Antitrust Resolution In Teams Case

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)