Advertisement|Remove ads.

Coty Stock In Spotlight As Q2 Earnings Miss Estimates, But Retail’s Optimistic

Shares of Coty Inc. ($COTY) were in focus on Monday as the company posted worse-than-expected second-quarter earnings, but retail sentiment stayed upbeat.

For Q2, Coty posted earnings per share of $0.11, missing Wall Street estimates of $0.21. Revenue stood at $1.67 billion, below the consensus estimates of $1.72 billion.

The Q2 sales reflected further slowing of the mass beauty market, particularly color cosmetics, together with continued headwinds in the APAC region, particularly China, Travel Retail Asia and Australia, according to a company statement. At the same time, its global fragrance market showed robust growth, with estimated sales for Coty's prestige fragrance portfolio increasing at a high single-digit percentage in the first half.

"As we are now midway through our fiscal year, it is clear that FY25 is shaping up to be a pivotal year. On the one hand, the global beauty market continues to grow at a healthy pace, even if growth has moderated off of the elevated levels of the last few years, which benefited from more material pricing increases,” said Sue Nabi, Coty's CEO.

Nabi added, “The beauty market has changed significantly since we first laid out our strategy and ambitions over 3 years ago. From a category perspective, fragrances have accelerated significantly supported by structural consumer behavior shifts, while color cosmetics is challenged by evolving channel preferences and new business models.”

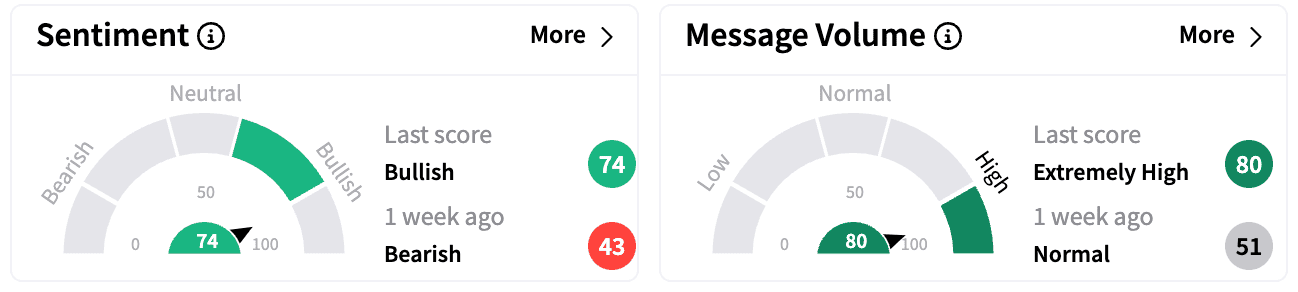

Sentiment on Stocktwits improved to ‘bullish’ from ‘bearish’ a week ago. Message volumes climbed into the ‘extremely high’ zone.

In the second quarter, its adjusted gross margin expanded by 170 basis points year-on-year.

Coty’s portfolio of beauty brands includes fragrance, color cosmetics, and skin and body care. Coty serves consumers with mass market products in over 120 countries and territories.

Coty stock is down 2.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)