Advertisement|Remove ads.

CRCL Stock Rises After Half-Billion USDC Mint On Solana Following Tether Downgrade

- Circle shares rose 11% in Friday morning trade following the USDC minting.

- The uptick in its stock price also comes after Tether was downgraded by S&P Global earlier this week.

- Circle and Tether have together minted $17.75 billion in stablecoins since the October 11 flash crash.

Shares of stablecoin issuer Circle (CRCL) gained in morning trade on Friday after data showed the company had minted 500 million USD Coin (USDC).

The issuance comes on the heels of Circle’s primary competitor, Tether (USDT), getting downgraded to ‘weak’ from ‘constrained’ by S&P Global on Wednesday. CRCL’s stock was up 11%, with retail sentiment on Stocktwits dipping to ‘bearish’ from ‘neutral’ over the past day. Chatter fell to ‘low’ from ‘normal’ levels.

Circle Mints More USD Coin

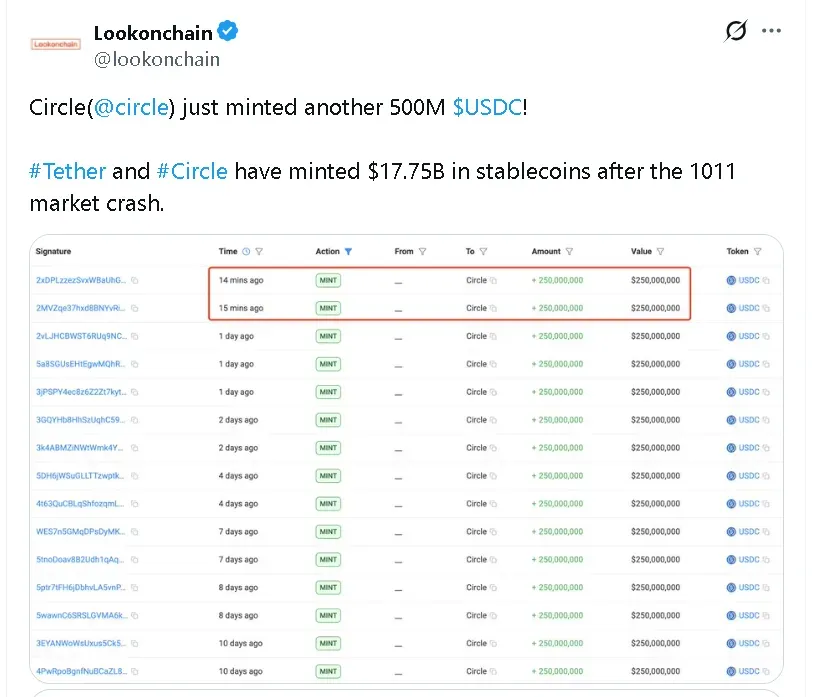

The minting occurred in two separate transactions on the Solana (SOL) network, each valued at $250 million, according to data on Arkham intelligence. Solana’s price edged 0.8% higher over the past 24 hours, and retail sentiment on Stocktwits remained in ‘bearish’ territory. Chatter around the altcoin dipped to ‘low’ from ‘normal’ levels.

The uptick in issuance reflects a broader expansion in stablecoin supply following the October 11 flash crash. On-chain analytics firm Lookonchain noted that Circle and Tether have collectively minted $17.75 billion in new stablecoins since the market drop.

Circle Stock Recovers After Tether Downgrade

Circle’s stock had dipped below its IPO price of $69 earlier this week amid weakness in Bitcoin (BTC) and other cryptocurrencies. However, on Wednesday, the shares began to rise after S&P Global downgraded Tether’s USDT to the lowest rating on its chart – ‘weak’.

The agency said Bitcoin now accounts for a larger share of reserves than the stablecoin’s safeguard margin allows, increasing the risk that USDT may not be fully backed if crypto markets continue to fall. S&P added that growing exposure to volatile assets, such as Bitcoin, and ongoing disclosure gaps now pose a material risk to the quality of USDT’s reserves.

Circle’s stock is currently trading around $81, up 26% since its market debut in June.

Read also: Bitcoin Holds Near $91,000 While Crypto Market Attempts To Regain Footing – DOGE, SOL Lead Losses

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)