Advertisement|Remove ads.

CrowdStrike Acquires Security Startup SGNL For $740 Million To Strengthen Identity Security

- The deal is expected to close in CrowdStrike’s first quarter (Q1) of FY27.

- SGNL’s acquisition will equip CrowdStrike to extend dynamic authorization across SaaS and hyperscaler cloud access layers.

- CrowdStrike will deliver continuous, real-time access control that eliminates the known and unknown gaps from legacy standing privileges, CEO George Kurtz said.

Crowdstrike Holdings Inc. (CRWD) announced on Thursday that it will acquire SGNL, a continuous identity management startup to accelerate its push in identity security.

The deal will equip CrowdStrike to extend dynamic authorization across SaaS and hyperscaler cloud access layers, the company said in a statement.

“AI agents operate with superhuman speed and access, making every agent a privileged identity that must be protected,” said George Kurtz, CEO and founder of CrowdStrike.

“With SGNL, CrowdStrike will deliver continuous, real-time access control that eliminates the known and unknown gaps from legacy standing privileges. This is identity security built for the AI era,” he added.

Shares of CRWD fell over 3% at the time of writing.

Deal Contours

According to a report from Reuters, the deal is valued at $740 million and aims to enhance CrowdStrike’s cybersecurity tools to assist customers with countering artificial intelligence-powered threats.

CrowdStrike said in its statement that the purchase price for SGNL would likely be paid predominantly in cash with a stock portion that would be subject to vesting conditions.

The deal is expected to close in CrowdStrike’s first quarter (Q1) of FY27.

Identity Security

As per the company, the deal will enable CrowdStrike to tackle identity security, which is rapidly growing to be one of cybersecurity’s largest and fastest-growing segments.

The company added that legacy access models built on static policies and standing privileges cannot reassess risk or revoke access as threat conditions change, making organizations susceptible to AI threats.

Meanwhile, SGNL’s Falcon platform will correlate identity, asset, and threat intelligence across endpoint, cloud, and SaaS environments, helping continuous, risk-aware authorization at scale.

How Did Stocktwits Users React?

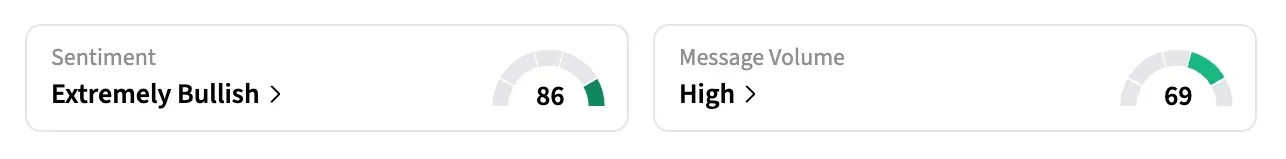

On Stocktwits, retail sentiment around CRWD shares remained in the ‘extremely bullish’ territory at the time of writing amid ‘high’ message volumes.

Shares of CRWD have gained over 29% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)