Advertisement|Remove ads.

CrowdStrike Stock Slumps Post Q1 Print As Analysts Turn Cautious: Retail Seizes Pullback Opportunity

CrowdStrike Holdings, Inc. (CRWD) shares declined over 7% in Wednesday’s premarket after analysts downgraded the stock following a first-quarter (Q1) revenue miss and soft guidance.

The cybersecurity vendor’s Q1 revenue grew 20% year-on-year (YoY) to $1.10 billion, marginally missing the consensus estimate of $1.105 billion, as per Finchat data.

The adjusted earnings per share (EPS) of $0.73 surpassed an estimate of $0.66.

BofA lowered its rating on the stock from ‘Outperform’ to ‘Neutral’, but increased the price target to $470 from $420, as per TheFly.

The firm remains positive on CrowdStrike's core business and growth outlook, but believes the current valuation limits further gains. The new target implies only about a 3% upside from the stock’s current levels.

Notably, the company’s sales growth slowed to below 20% in the first half of fiscal year 2026. While BofA anticipates growth to rebound to around 22% in the second half due to renewals related to CCP (customer commitment packages), it expects a longer-term slowdown in growth over the coming years.

Canaccord analyst Kingsley Crane lowered his rating on CrowdStrike to ‘Hold’ from ‘Buy’, while increasing the price target to $475 from $420.

In a note to investors, Crane noted that although the company delivered strong Q1 results, its profit margins were weaker than those of the same quarter last year.

He expressed optimism about initial signs of growth within the Flex customer segment and said CrowdStrike’s performance following the July 19 incident of a faulty update was “truly exceptional.”

However, Canaccord now sees a more balanced risk/reward profile, given the stock is trading at approximately 21 times projected 2026 revenue.

Evercore ISI lowered its rating on CrowdStrike to ‘In Line’ from ‘Outperform’ and reduced the price target to $440 from $450.

In a note to investors, the brokerage stated that the company delivered a well-executed Q1, although it fell short of being outstanding.

The firm also highlighted increasing investor concerns regarding several unresolved issues at CrowdStrike and indicated that it is adopting a more cautious stance.

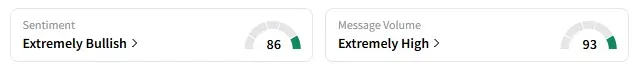

On Stocktwits, retail sentiment around CrowdStrike remained in ‘extremely bullish’ territory.

A Stocktwits user is buying the dip in the shares.

Another user noted that buying the dip has become a pattern after every quarterly earnings report of the company.

CrowdStrike stock has gained over 42% in 2025 and over 59% in the last 12 months.

Also See: Nvidia Reclaims Market Cap Crown From Microsoft As AI Mania Persists; Retail Stays Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)