Advertisement|Remove ads.

Cummins Stock Rises After Goldman Sachs Upgrades To ‘Buy’: Retail Still Leans Bearish

Cummins (CMI) stock rose 2.9% on Tuesday after Goldman Sachs upgraded the stock to “buy” from “Neutral.”

The brokerage also raised the price target for the stock to $431 from $410. The new price target represented a significant upside compared to the stock’s last close.

The stock has a consensus price target of $350.36, according to FinChat data.

According to TheFly, the brokerage sees structurally higher Power Systems profitability and "derisked" Environmental Protection Agency 2027 expectations.

The so-called EPA 27 rules proposed more stringent greenhouse gas standards for both light-duty and medium-duty vehicles. However, the Trump administration has loosened the regulations.

Goldman sees attractive unit profitability across a range of EPA 27 outcomes for Cummins.

Earlier this month, Citi raised the price target for the stock to $350 from $320, as per TheFly.

The brokerage continues to anticipate Cummins' earnings to rise by double-digit percentage points in 2026 and 2027, driven by a recovery and margin expansion in core end-markets, as well as continued growth within its Power Systems segment.

The power solutions and engine manufacturer had withdrawn its full-year outlook over tariff concerns earlier this month.

It had also topped earnings and revenue estimates despite sales declining in both North America and international markets.

Citi analysts were also constructive on Cummins’ ability to minimize tariff impacts over the next six to 12 months.

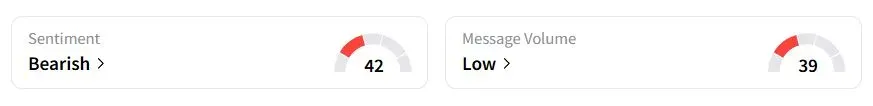

Retail sentiment on Stocktwits was in the ‘bearish’ (42/100) territory, while retail chatter was ‘low.’

Cummins stock has fallen nearly 7% this year amid uncertainty related to tariffs and declining engine sales.

Also See: America Likely To Get Veto Powers After US Steel’s Merger With Nippon, Retail Cheers

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)