Advertisement|Remove ads.

America Likely To Get Veto Powers After US Steel’s Merger With Nippon, Retail Cheers

U.S. Steel (X) continued to garner retail attention on Tuesday after reports and the comments from a lawmaker indicated that the U.S. would likely hold veto powers over key decisions at the 124-year-old firm.

The stock rose 2% during the regular trading session, after touching a 14-year high on Friday when Trump indicated his approval for the company’s merger with Japan’s Nippon Steel.

"It'll be a U.S. CEO, a U.S. majority board, and then there will be a golden share, which will essentially require U.S. government approval of a number of the board members, and that will allow the United States to ensure production levels aren’t cut and things like that," said Republican Senator David McCormick of Pennsylvania in a CNBC interview.

The first-time senator’s comments followed a report by Nikkei, which mentioned that Nippon and the U.S. were exploring the issuance of a so-called golden share, which allows the holders of such shares to outvote others in some specific cases.

However, McCormick did not elaborate on the administration’s final decision on the original $14.9 billion acquisition deal.

Bloomberg reported, citing people familiar with the matter, that the agreement tabled in front of the Committee on Foreign Investment in the U.S. (CFIUS) and the Trump administration included the original $55 per share offer alongside additional investments.

It was also not clear whether the powers granted to the U.S. would include an equity stake or just mitigation powers, the report added.

The deal, announced in December 2023, has faced numerous roadblocks, with both Joe Biden and Trump voicing their opposition to the agreement during an intense campaign in the crucial swing state of Pennsylvania.

Biden even blocked the deal during the last days of his administration after the first CFIUS review on national security grounds. Trump ordered a fresh review following requests by both the companies and even the Japanese Government.

On Friday, Trump announced a partnership that would bring $14 billion to the U.S. economy and keep the company U.S.-owned without divulging details.

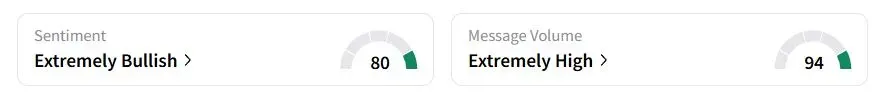

Retail sentiment on Stocktwits was ‘extremely bullish’ (80/100) territory, while retail chatter was ‘extremely high.’

“Let's wrap this deal before anyone changes their mind. I expect a quick close,” one user said.

U.S. Steel stock has gained 55% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)