Advertisement|Remove ads.

CVS Health CFO Says Company Maintaining Prudent View On Medical Cost Trends Through Remainder Of Year

CVS Health Corporation (CVS) CFO Brian Newman said during the firm’s earnings call on Thursday that the company raised its full-year profit guidance while maintaining a prudent outlook on medical cost trends.

“While medical cost trends remain elevated versus historical periods, in aggregate, they are generally in line to slightly better than our expectations so far this year,” Newman said. “Given this elevated trend environment, we are maintaining a prudent view on medical cost trends through the remainder of the year."

The company now expects its full-year medical loss ratio to be approximately 91%, reflecting the actions taken to improve operations in its Aetna health insurance segment.

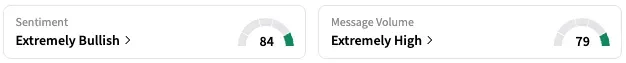

On Stocktwits, retail sentiment around CVS jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user sounded optimistic following the earnings beat.

Another user noted that the earnings beat from CVS and Humana (HUM) show that things in the health insurance sector aren't “as bad as people are making it out to be.”

CVS’ second-quarter earnings surpassed Wall Street expectations. The company now expects full-year adjusted earnings per share of $6.30 to $6.40, up from its previous guidance of $6.00 to $6.20. The firm also expects full-year total revenue to be $391.5 billion, above an analyst estimate of $386.77 billion.

CVS operates drugstore chains and a pharmacy benefit management business while also providing insurance through its Aetna segment.

For the second quarter, CVS reported total revenues of $98.91 billion, up from $91.23 billion in the corresponding period of 2024, and above an analyst estimate of $94.59 billion, according to data from Fiscal AI.

The company’s adjusted earnings per share for the period came in at $1.81, down from $1.83 in Q2 2024, but above an analyst estimate of $1.46.

CVS Health's Aetna insurance business reported a medical loss ratio, or the percentage of premiums spent on medical costs, of about 89.9% in the second quarter, up from 89.6% in the corresponding quarter of 2024.

CVS stock is up by 41% this year and by about 5% over the past 12 months.

Read also: Moderna Announces 10% Layoffs Ahead Of Q2 Report: Retail Now Eyes ‘Good Enough’ Earnings

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)