Advertisement|Remove ads.

Moderna Announces 10% Layoffs Ahead Of Q2 Report: Retail Now Eyes ‘Good Enough’ Earnings

Vaccine maker Moderna (MRNA) on Thursday said that the company will reduce its headcount by about 10% globally to shrink its workforce to fewer than 5,000 individuals by the end of the year.

The announcement comes ahead of the company's second-quarter (Q2) earnings, slated for Friday. Shares of the company traded 2% lower at the time of writing.

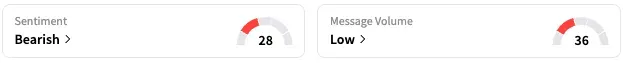

On Stocktwits, retail sentiment about MRNA trended in the ‘bearish’ territory, coupled with ‘low’ message volume.

A Stocktwits user, however, brushed the news aside, opining that the approval for the company’s melanoma vaccine in the future is what will make or break it.

Another user expects the earnings report to be “good enough” to offset the layoff news.

CEO Stéphane Bancel said in a note to employees on Thursday that the move is part of the company’s commitment to reduce annual operating expenses by about $1.5 billion by 2027 as sales of its Covid-19 vaccines slump.

The company has made significant progress towards its cost-cutting targets by scaling down research and development, renegotiating supplier agreements, and reducing manufacturing costs, he said, but noted that the initiatives were not enough.

“Every effort was made to avoid affecting jobs,” he said. “But today, reshaping our operating structure and aligning our cost structure to the realities of our business are essential to remain focused and financially disciplined, while continuing to invest in our science on the path to 2027.”

The CEO also added that the company’s future is bright, provided the potential for up to eight more approvals in the next three years.

Analysts on average expect the company to report a Q2 loss of $3 per share, narrower than the $3.33 loss reported in the corresponding quarter of 2024, according to data from Fiscal AI.

MRNA stock is down by 24% this year and by about 74% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)