Advertisement|Remove ads.

CVS Showered With Upgrades, PT Hikes After Q4 Beat Powers Stock To Best Day In Over 25 Years: Retail Cheer Grows

Shares of CVS Health Corp. continued climbing premarket Thursday after a blockbuster session driven by stronger-than-expected quarterly earnings.

The stock surged nearly 15% on Wednesday, marking its best single-day gain since Oct. 6, 1999.

According to The Fly, Cantor Fitzgerald upgraded CVS to 'Overweight' from 'Neutral', raising its price target to $71 from $62, citing confidence in a turnaround and Medicare Advantage margin recovery by 2027.

The research firm believes the current implied multiple on the Aetna business "materially undervalues the asset."

Leerink upgraded the stock to 'Outperform' from 'Market Perform,' lifting its target to $75 from $55, saying it sees the "important stabilization signs we've been waiting for" on Aetna and healthcare benefits.

Wells Fargo raised its target to $73 from $68, noting better-than-expected Q4 results and promising guidance. Barclays raised the firm's price target on CVS Health to $73 from $71 and kept an ‘Overweight’ rating.

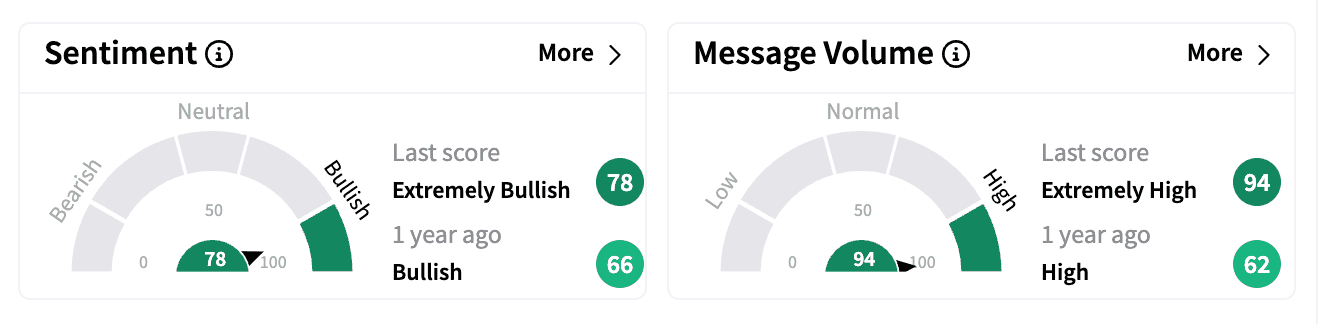

On Stocktwits, sentiment turned 'extremely bullish,' with message volume hitting its highest level in a year after soaring over 800% in the previous session.

One user felt "healthcare is about to have a moment" in the next few months following the results.

Another credited Glenview Capital CEO Larry Robbins for the results. The hedge fund took about a 1% stake last year in CVS, pushing for operational improvements.

CVS reported Q4 adjusted earnings per share (EPS) of $1.19, beating the $0.91 estimate, with nearly $98 billion in revenue.

Its 2025 guidance calls for adjusted EPS of $5.75 to $6 as the company navigates headwinds in its Aetna Medicare Advantage segment while continuing cost-cutting efforts.

CVS shares, which trade at 10.8 times estimated 2025 earnings, have gained more than 40% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)