Advertisement|Remove ads.

GH Research Stock Grabs Retail Spotlight Ahead Of FDA Update On Depression Treatment

- GH Research is scheduled to update on the FDA status of GH001 and outline its global Phase 3 plans for treatment-resistant depression on Monday.

- The update follows the company’s submission of a complete response to the FDA after a prior clinical hold.

- Progress across competing psychedelic-based depression programs has increased focus on the stock.

Shares of GH Research PLC drew increased retail attention on Monday ahead of a scheduled update on its FDA Investigational New Drug application for GH001, the company’s inhaled therapy for treatment-resistant depression, and its plans for a global Phase 3 program, due at 7:00 a.m. EST.

Phase 3 Program And FDA Update In Focus

The update follows the company’s June disclosure that it submitted a complete response to the FDA addressing a previously announced clinical hold on the IND. At the time, GH Research said the submission included completed toxicology studies and comprehensive responses to the agency’s requests, adding that it had worked closely with regulators and submitted the response ahead of schedule.

GH001 Data Anchors Development Path

GH001 is GH Research’s lead experimental therapy, delivered through a proprietary inhalation system and designed to treat patients with treatment-resistant depression, a condition where standard antidepressants have failed.

In February 2025, the company reported results from a Phase 2b study involving 81 patients. Those treated with GH001 showed a significant improvement in depression symptoms within eight days, with scores on a standard clinical scale falling by an average of 15.5 points more than placebo. The difference was statistically significant.

Over half of the patients receiving GH001 achieved remission by Day 8, compared with none in the placebo group. The company said all secondary study goals were met, and the treatment was well tolerated, with no serious adverse events reported during the blinded phase of the trial.

Longer-term follow-up data showed sustained benefits. Among patients who completed six months of follow-up, nearly 78% remained in remission, with most requiring only a small number of additional treatments. As of late January 2025, the company reported no serious safety issues during this extended period.

Psychedelic Race Intensifies

In November, H.C. Wainwright lowered its price target on GH Research to $35 from $40 while maintaining a ‘Buy’ rating, citing competitive momentum from programs such as Atai Beckley’s BPL-003 and AbbVie’s GM-2505, as well as the prior FDA hold.

In October, Needham initiated coverage with a ‘Buy’ rating and a $19 price target, citing GH001’s Phase 2 efficacy and remission data and estimating potential U.S. sales of $1.9 billion by 2035.

How Did Stocktwits Users React?

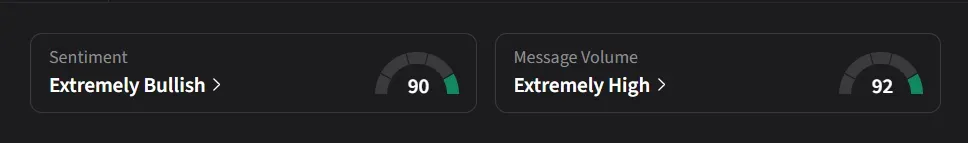

On Stocktwits, retail sentiment for GH Research was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user grouped GH Research alongside names like Disney, Marathon Digital, Critical Metals and Navitas Semiconductor, saying the stock continues to sit within a cluster of “hot themes” across the market.

Another user said they plan to sell part of their position around the FDA update to lock in gains and hold the rest into the next company update later in the quarter.

GH Research’s stock has risen 89% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)