Advertisement|Remove ads.

Cyberattack, Q4 Earnings Miss Drag Krispy Kreme Stock To All-Time Low: Retail Sees Buying Opportunity

Shares of Krispy Kreme (DNUT) climbed 0.30% after-hours on Tuesday after diving more than 21% in regular trading to hit an all-time low on the back of disappointing quarterly results and a huge impact from a cyberattack, even as retail sentiment stayed upbeat.

Krispy Kreme's Q4 earnings per share came in at $0.01, missing Wall Street expectations of $0.10. Its revenue stood at $404 million, a decline of 10.4%, missing revenue expectations of $414.01 million.

The Q4 sales decline was primarily due to the sale of a majority ownership stake of Insomnia Cookies in Q3 2024, which resulted in a $101 million impact.

Meanwhile, Krispy Kreme said that the cybersecurity incident disrupted certain IT systems, affecting operations, including online ordering in parts of the U.S. The company incurred approximately $3 million in remediation expenses related to the incident during the fourth quarter.

In addition, it saw lost revenue within its U.S. segment of about $11 million related to the incident and a corresponding estimated $10 million impact on adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

For 2025, Krispy Kreme anticipates 5%-7% organic revenue growth amounting to $1.56 billion to $1.65 billion. Adjusted EPS is expected between $0.04 and $0.08.

“We delivered an 18th consecutive quarter of year-over-year organic sales growth. Excluding the estimated cybersecurity incident impact, results were largely in line with our expectations,” said CEO Josh Charlesworth.

Charlesworth noted the company’s recent efforts towards restructuring its management teams to maximize profitable U.S. expansion and “capital-light” international growth.

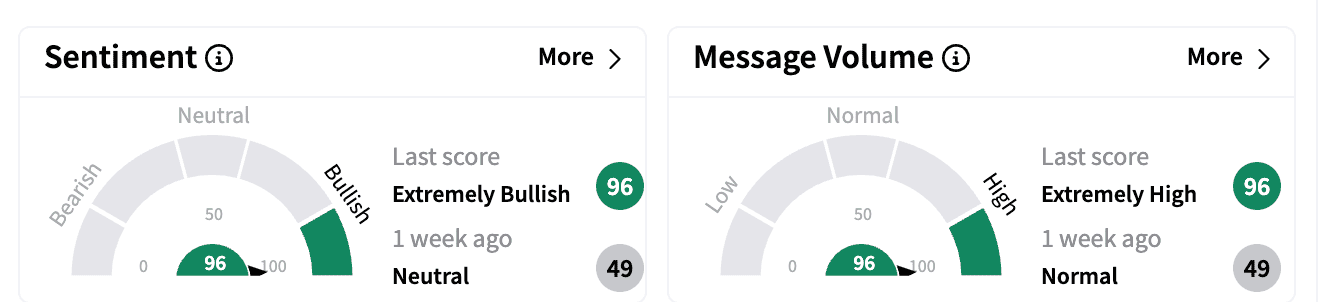

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘neutral’ a week ago. Message volume moved up to the ‘extremely high’ territory from ‘normal.’

One bullish comment suggested the stock was an opportunity for long-term investors.

Charlotte, N.C.-based Krispy Kreme operates in 40 countries through its network of fresh doughnut shops and partnerships with leading retailers. It also has a growing digital business with more than 17,500 fresh points of access.

Krispy Kreme stock is down 28.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)