Advertisement|Remove ads.

Cyient Shares Slide Over 9% As Lack Of Guidance Weighs On Investor Sentiment

Cyient’s stock saw a sharp decline of over 9% on Friday, following the IT service provider’s Q4 FY25 earnings report.

The selloff is attributed to a combination of declining revenues, margin pressures, and the absence of forward guidance, which have collectively dampened investor sentiment.

Cyient reported consolidated revenue of ₹1,909.2 crore for Q4 FY25, while profits stood at ₹170.4 crore, reflecting a 9.94% fall.

Margins contracted to 16.9% from 20.1% year-on-year.

Investors were unsettled by the company's decision not to provide guidance for the upcoming fiscal year, citing macroeconomic uncertainties.

This cautious outlook offset optimism around its newly launched semiconductor subsidiary. While the semiconductor arm represents a strategic push, investors are concerned about the margin pressures overshadowing its long-term potential.

Despite the challenges, the company’s board declared a final dividend of ₹14 per share, bringing the total dividend for FY25 to ₹26 per share.

Brokerages are bearish on the counter with Emkay Global and Kotak Securities sharing a 'reduce' call and trimming their target prices, according to a report.

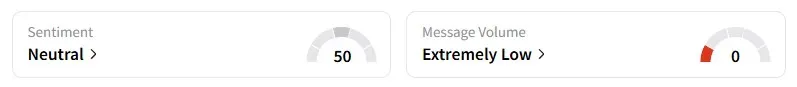

Data on Stocktwits shows that retail sentiment remained ‘neutral’ for Cyient late on Friday morning.

Cyient stock has fallen 38% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)